The US leads the world in fruit and nut imports, but is our out-of-season produce hurting the planet?

Petrovich Nataliya // Shutterstock

The US leads the world in fruit and nut imports, but is our out-of-season produce hurting the planet?

Person holding avocado in market.

Even in the dead of winter, American shoppers are treated to a cornucopia of choice in the grocery aisles. Peruvian grapes, Costa Rican pineapples, Mexican strawberries—many pantry staples begin their journeys to American tables thousands of miles away.

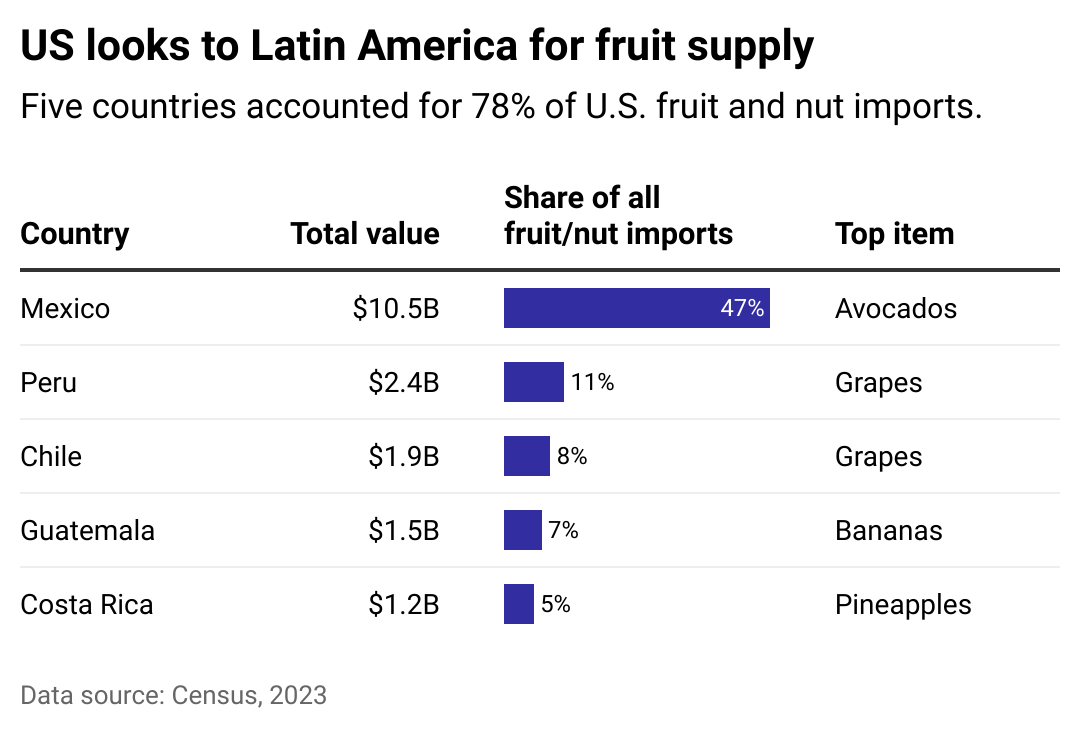

In 2022, more than half of the fruits and nuts consumed by Americans are imported, based on the latest USDA data. What’s more, just one trading partner makes up close to 48% of fruit and nut import value. Who else made it to the list? Using 2023 Census data, Live It Up broke down the top countries that provide fresh fruit and nuts to U.S. consumers.

Though farm-to-table and slow food movements have been buzzwords in the industry, imports have been steadily increasing over the past decades, aided by a number of factors, including better transportation infrastructure, container shipping, and storage technology. An increasingly diverse American population has also brought a more global diet that includes fruits such as avocados and papayas. But, it is legislation that has had a large impact on what shoppers can purchase.

The North American Free Trade Agreement, which came into effect in 1994, eliminated import and export tariffs from goods traded between the U.S., Mexico, and Canada, ushering in a new era of free trade. It also granted each country “most-favored-nation” status for trading.

NAFTA gave U.S. consumers unprecedented access to year-round warm climates for growing fresh produce, which made way for a surge of fruits and nuts from abroad. Whereas, in 2008, imports accounted for nearly 36% of fruit and nuts in value, they accounted for nearly 60% by 2022.

Easy access to produce grown in tropical climates has also coincided with changing taste buds in the U.S. For example, after NAFTA came into force, the amount of avocados available per person—an indicator of consumption—tripled to nearly 8 pounds as of 2021.

In 2023, the U.S. imported $22.37 billion worth of fruits and nuts, but only exported about $14.87 billion. The large deficit stems from fruit as opposed to nuts. According to the Observatory of Economic Complexity, the U.S. is the world’s largest exporter of nuts, such as almonds, pistachios, and walnuts. In 2022, the U.S. exported a total of $8.33 billion of nuts around the world and imported $989 million. Mexico was the largest partner and accounted for $478 million of imports.

![]()

Live It Up

Mexico is the main source of US fruit and nut imports

Table showing that the U.S. looks to Latin America for fruit and nut supply. Five countries accounted for 78% of U.S. fruit and nut imports in 2023. These countries are Mexico (47%), Peru (11%), Chile (8%), Guatemala (7%), Costa Rica (5%).

Mexico is not just the largest market for U.S. nuts; the country, in turn, outpaces other food and nut partners in American groceries. Shoppers frequently purchase avocados from Mexico, but also raspberries, strawberries, grapes, lemons, and limes. Factors such as proximity to the U.S. via a shared land border, tropical climate, and relatively low labor costs contribute to Mexico’s status as a top U.S. trading partner.

Although NAFTA brought many benefits, such as increasing variety in U.S. supermarkets and boosting investment and trade between its member states, some of its broader effects may not be so palatable. For example, the presence of U.S. companies in Mexico has increased fertilizer and chemical-related pollution and deforestation rates, contributing to global warming. Increased import of goods has also led to more carbon emissions. A study published in June 2022 in Nature Food reported that transporting food accounts for around 19% of total food-system emissions.

Transportation is just one facet of the discussion, however, as sustainability expert Pablo Päster explained on Treehugger. There is also the suitability of growing fruits in their natural climates to consider.

“[The] net emissions will likely favor the imports because non-tropical climates simply do not support the efficient production of tropical fruits,” Päster wrote. Using fertilizers and pesticides, watering requirements, and greenhouse infrastructure to grow tropical fruits domestically all add to its emissions—additions that may not be needed when fruit production happens in the proper climate.

From a nutritional perspective, it is easy to see how increased availability and consumption of fresh produce positively impacts health. Yet, while U.S. consumers may benefit from the increased availability of fruits and nuts, some argue that free trade may have had the opposite impact on partner countries. Mexico has ended up importing more unhealthy processed foods. Some critics also note that Mexico missed a window for more development by removing industry protections without a guarantee of investments from its richer partners. The U.S., too, saw its manufacturing jobs move south across the border.

In 2020, NAFTA was replaced with the United States-Mexico-Canada Agreement. USMCA is in many ways an extension of NAFTA in that it places zero tariffs on the same agricultural products while providing broader opportunities for U.S. exports to Canada of dairy, poultry, and egg products. This means that even though NAFTA is no longer with us, trends in the trade of fruit and nuts are likely to continue.

Story editing by Carren Jao. Additional editing by Kelly Glass. Copy editing by Kristen Wegrzyn.

This story originally appeared on Live It Up and was produced and

distributed in partnership with Stacker Studio.