Average length of a car loan nears 70 months

fongbeerredhot // Shutterstock

Average length of a car loan nears 70 months

A car figure on top of a calendar.

The average car loan term is 68.48 months for a new car and 67.41 months for a used car, or close to six years, according to Experian data. The average length of auto loans for new and used vehicles has remained fairly steady since last year, reflecting the continuing popularity of longer-term auto loans. While longer auto loans offer more affordable monthly payments, they can ultimately end up costing more in total interest than loans of 60 months or less.

Average New Car Loan Term

The latest Experian State of the Auto Finance Market report found the average term for new car loans—the number of months it takes to pay off loans on new cars—rose to 68.48 months in the second quarter (Q2) of 2024, a slight increase from 68.29 in Q2 2023. Auto loans are typically offered with terms of 48, 60, 72 or 84 months.

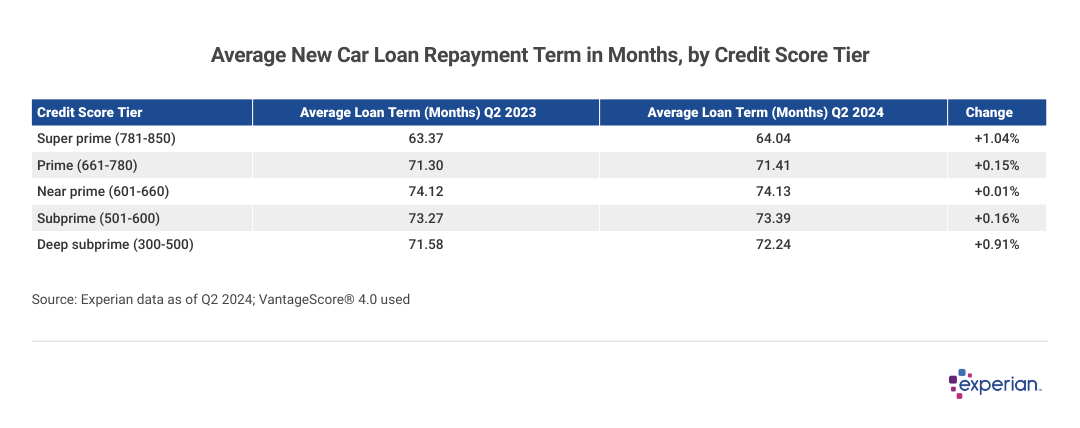

When new car borrowers are segmented by credit score, however, average loan terms for all but the most creditworthy borrowers exceeded 72 months (or six years). Super prime and deep subprime borrowers saw the biggest change, with average loan terms increasing by about three weeks.

![]()

Experian

Average Used Car Loan Term

Table showing the “Average New Car Loan Repayment Term in Months, by Credit Score Tied”.

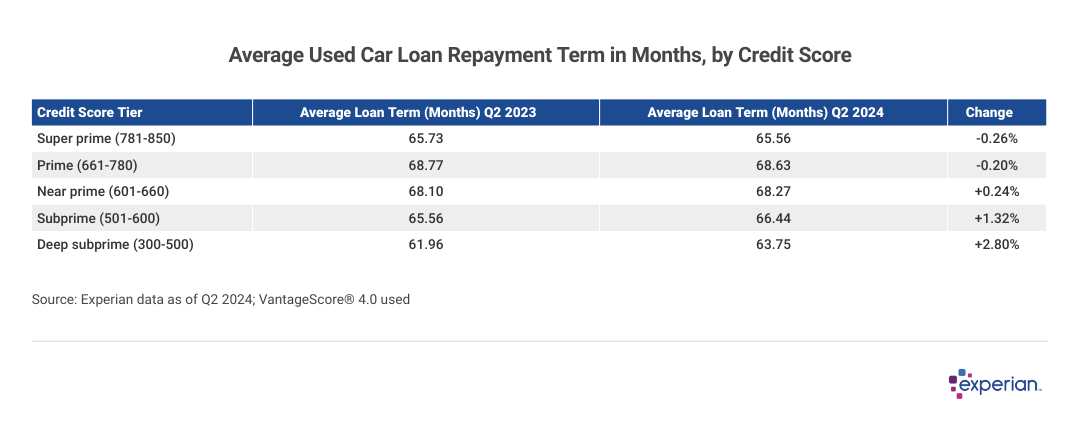

Average used car loan terms also held fairly steady, except for subprime and deep subprime borrowers. The average loan term for subprime borrowers increased by nearly a month, while deep subprime borrowers saw loan terms increase by an average of close to two months.

Experian

Longer-Term Loans Gain Popularity

Table showing the “Average Used Car Loan Repayment Term in Months, by Credit Score”.

As has been the case for a few years, loans with terms of 61 months or more account for the majority of both new and used car financing. Although the popularity of these loans increased in the past year, the percentage of loans with the longest terms—73 months or more—dropped slightly for both used and new cars.

New car financing

Slightly less than 70% of new car loans (69.62%) have terms of 61 months or more (longer than five years), representing a small increase from 69.54% in Q2 2023. However, the percentage of new car loans in the 61- to 72-month range rose from 38.45% to 40.78%, an increase of 6.05%. At the same time, the percentage of new car loans with terms of 73 months or more dropped by 7.23%, from 31.09% in 2023 to 28.84% in 2024.

Used car financing

More than 70% of used car loan terms are 61 months or more, up slightly from 69.85% in Q2 2023. However, the percentage of used car loans with terms of 73 months or more declined by 3.4%, from 26.78% in Q2 2023 to 25.86% for the same period in 2024. The percentage of loans with terms of 85 months or more reached 0.95%, up slightly from 0.91% in 2023.

What Is the Average Term Length for a New Lease?

Terms for new auto leases are holding fairly steady compared to the same time last year. Overall, new auto lease terms decreased only slightly, from 35.91 months in Q2 2023 to 35.86 months in Q2 2024.

When segmented by credit score, changes in lease terms broke out a bit differently, with terms increasing for all but super-prime borrowers.

- Super prime borrowers: The average lease term dropped to 35.34 months in Q2 2024 from 35.46 months a year prior.

- Prime borrowers: Terms rose slightly, from 36.17 months on average in Q2 2023 to 36.20 months for the same period in 2024.

- Near prime borrowers: They saw average lease terms increase from 36.59 months in 2023 to 36.65 months in Q2 2024.

- Subprime borrowers: Average lease terms rose from 36.49 months in Q2 2023 to 36.53 months in 2024.

Experian

How Longer Auto Loan Terms Can Cost You More

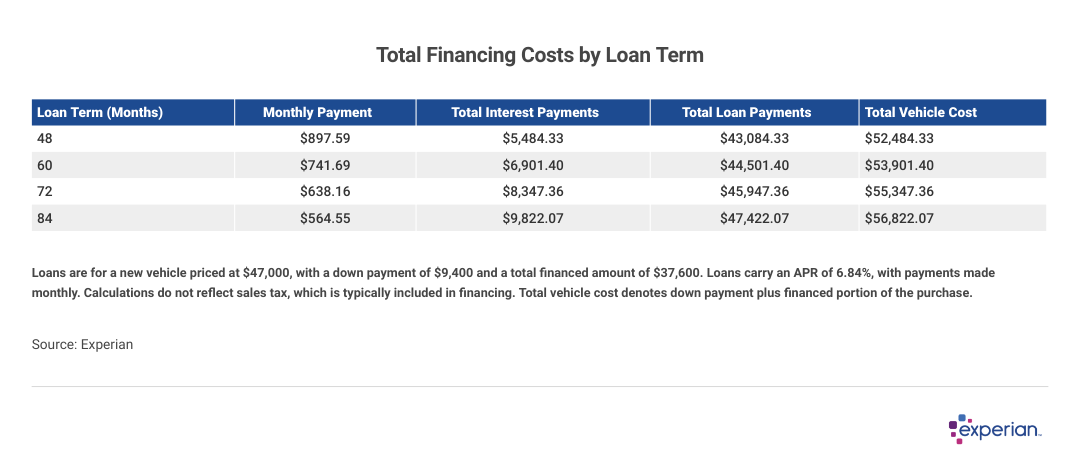

Table showing the “Total Financing Costs by Loan Term”.

Longer auto loan terms offer lower monthly payments, which are easier on your budget in the short run. The tradeoff: A longer-term loan ultimately costs a lot more in interest, and the higher the loan’s interest rate, the more you’ll end up paying.

Consider the following comparison of total purchase costs for a new vehicle, based on a 6.84% interest rate (the average for Q2 2024, according to Experian data), a $47,000 purchase price and a $9,400 down payment. The monthly payment on an 84-month loan is about two-thirds of the payment on a 48-month loan. However, you’ll pay almost twice as much interest for the longer loan, costing you an additional $4,337.74 over the 84-month term.

To compare various auto loan offers, calculate the vehicle’s total cost and the total interest. Here’s how: Multiply the monthly payment by the total number of payments to get the total amount the loan will cost. Then subtract the amount you’re borrowing from that amount to calculate the total interest cost you’ll pay. (You can also use Experian’s car payment calculator to determine these amounts.)

Finally, calculate the total cost of the vehicle purchase by adding your down payment amount to the total you’ll pay on the loan.

Long-term car loans have other downsides, as well. For example, you could end up “upside down” on the loan, meaning you owe more on the vehicle than it’s worth. If you’re upside down and your car is totaled, your car insurance won’t cover the full amount of your loan.

How to Choose the Right Auto Loan Term

Your auto loan term plays a big role in the loan’s cost. Although longer loan terms reduce your monthly payments, the extra interest you pay generally outweighs the month-to-month savings. If you’d need to stretch your auto loan over more than 72 months to manage payments, you may want to rethink how much car you can afford.

To make a shorter loan term work for you:

- Choose a used vehicle. New vehicles lose significant value in the first year after purchase. Prices of vehicles just one or two years old could be much lower, which could help you swing a shorter loan term.

- Make a bigger down payment. Adding an extra 5% to 10% of the vehicle cost to your down payment means borrowing less, which could make shorter-term loan payments more manageable.

- Shop around for the best deal. Before heading to the showroom, get prequalified by several auto lenders for estimates of the loan amounts and terms you could qualify for. Getting preapproved by those with the best offers can give you more bargaining power at the dealership. While prequalification doesn’t affect your credit score, preapproval requires more information and typically involves a hard inquiry on your credit report, which could cause a temporary dip (but may give you a better idea of how much you can afford). Restricting your preapproval applications to a 14-day window helps minimize damage to your credit score.

The Bottom Line

Along with loan terms, interest rates play a major role in the cost of an auto loan. If your loan prequalification offers have higher interest rates than you’d like, your credit score could be a factor. Borrowers with good credit are typically eligible for lower interest rates on auto loans. If you can wait six to 12 months to buy a car, taking steps to improve your credit score during that time could qualify you for lower interest rates and save you money.

This story was produced by Experian and reviewed and distributed by Stacker.