NW credit unions urge: Be smart with your stimulus check

SEATAC, Wash. (KTVZ) -- Millions of Americans will receive Economic Impact Payments from the U.S. Government as early as this week. For eligible consumers, the money will be deposited directly into their accounts at their financial services providers.

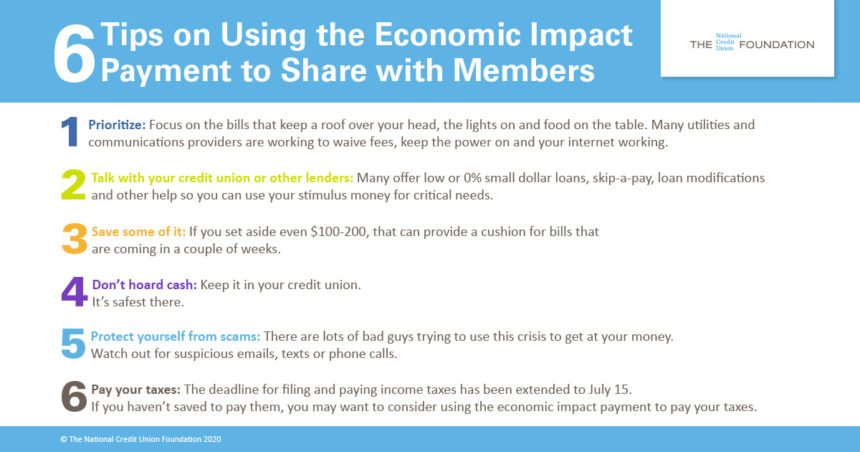

How can they use that money safely, and in a way that benefits their financial health? Northwest credit unions recommend that consumers:

- Prioritize! Focus on the things that keep a roof over your head, feed the family, and keep the utilities and Internet on. In fact, your local utility companies and communications providers may be waiving some fees to help you at this time.

- Talk. If you or a member of your family has lost a job, contact your credit union. Talk about your financial needs and find out what services are available to help you. As not-for-profit cooperatives, credit unions are providing options to members such as low-to-no interest emergency loans, and the ability to skip mortgage and car payments for as long as 90 days.

- Save. If you’re getting a stimulus check, try to save a little. Putting away $100 to $200 now will help you when bills come due later in the month or in the coming months.

- Don’t hoard cash. Your money is safer on deposit in your credit union than in your pocket. If your money is lost or stolen it can’t be replaced, but accounts in federally insured credit unions are guaranteed, up to $250,000.

- Protect your money. The scammers know millions of Americans are getting stimulus checks. Be on guard for suspicious emails, texts or phone calls asking for your personal information.

- Pay taxes. The deadline for filing and paying your 2019 taxes has been extended to July 15. Your stimulus check might help to pay that bill.

- Support. Some of your local restaurants are able to stay in business by offering take out food. Use a little bit of your stimulus check to pick up dinner for the family or buy a gift certificate to use when dining rooms are open again.

The first round of stimulus checks is going to more than 50 million consumers who have direct deposit information on file with the Internal Revenue Service or with the Social Security Administration. In the coming months, other consumers may receive hardcopy checks. More information on who is eligible can be found here.

We hope this information will be helpful to you in guiding your audience. If you need subject matter experts on financial services that are available, please contact us.

<END>

The Northwest Credit Union Association is the trade association representing more than 175 not-for-profit, cooperative credit unions in Idaho, Oregon, and Washington, and their 7.3 million consumer members. As not-for-profit cooperatives, credit unions look out for their members’ financial well-being. Everyone should open their eyes to a credit union. For more information, please visit: https://yourmoneyfurther.com