Nation’s average gas price ticks upward; Oregon’s falls 11 cents in past week, largest drop in US

PORTLAND, Ore. (KTVZ) – Rising oil prices fueled by worries over Russian oil production cuts have put upward pressure on pump prices, sending the national average higher. But Oregon and other West Coast states are bucking the trend, with gas prices continuing to decline.

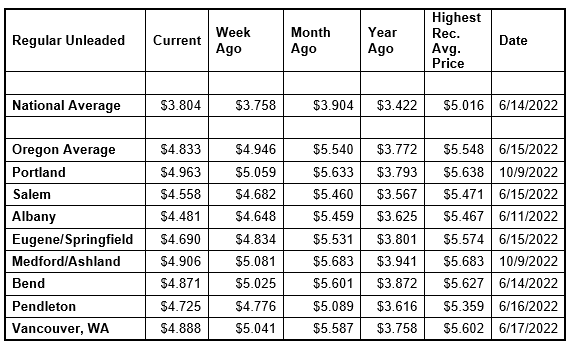

For the week, the national average for regular adds a nickel to $3.80 a gallon. The Oregon average falls 11 cents to $4.83. This is the largest weekly drop for a state in the nation.

“Oil prices have risen, in part due to concerns of tight global supplies as the European Union’s embargo on Russia’s seaborne crude exports will start in early December. Higher crude oil prices generally result in higher pump prices. However, reports of new COVID-19 restrictions in China signal a potential economic slowdown for the world’s top oil-consuming nation, so higher oil prices could be short-lived,” says Marie Dodds, public affairs director for AAA Oregon/Idaho.

Crude oil prices rose above $90 last week for the first time since October 7. Crude reached a recent high of $122.11 per barrel on June 8, and ranged from about $94 to $110 per barrel in July. In August, crude prices ranged between about $86 and $97. In September, crude prices ranged between about $76 and $88 per barrel. In October, crude ranged between $82 and $92 per barrel.

Crude prices rose dramatically leading up to and in the first few months of Russia’s invasion of Ukraine. Russia is one of the world’s top oil producers and its involvement in a war causes market volatility, and sanctions imposed on Russia by the U.S. and other western nations resulted in tighter global oil supplies. Oil supplies were already tight around the world as demand for oil increased as pandemic restrictions eased. A year ago, crude was around $72 per barrel compared to $89 today.

Crude oil is the main ingredient in gasoline and diesel, so pump prices are impacted by crude prices on the global markets. On average, about 56% of what we pay for in a gallon of gasoline is for the price of crude oil, 20% is refining, 11% distribution and marketing, and 14% are taxes, according to the U.S. Energy Information Administration.

Demand for gasoline in the U.S. dipped slightly from 8.93 million b/d to 8.66 million b/d for the week ending October 28. This compares to 9.50 million b/d at this time last year. Total domestic gasoline stocks decreased by 1.3 million bbl to 206.6 million bbl. Pump prices could increase if supply remains tight alongside rising oil prices.

Quick stats

Oregon is one of 22 states with lower prices week-over-week. West Coast states have the largest weekly drops: Oregon (-11 cents), Alaska (-9 cents), California (-9 cents), and Washington (-9 cents). Indiana (+33 cents) has the largest weekly gain. The average in Texas is flat.

California ($5.45) has the most expensive gas in the country for the ninth week in a row. California and Hawaii ($5.21) are the only two states with averages at or above $5 a gallon. This week 13 states, including Oregon, have averages at or above $4, and 37 states and the District of Columbia have averages in the $3-range.

The cheapest gas in the nation is in Georgia ($3.13) and Texas ($3.17). For the 96th week in a row, no state has an average below $2 a gallon.

The difference between the most expensive and least expensive states is $2.33 which continues to be significant.

Oregon is one of 36 states with lower prices now than a month ago. The national average is 10 cents more and the Oregon average is 71 cents less than a month ago. Oregon has the third-largest monthly decrease in the nation. California (-90 cents) and Alaska (-79 cents) have the largest monthly declines. Rhode Island (+41 cents) has the largest month-over-month jump.

Oregon is one of 49 states and the District of Columbia with higher prices now than a year ago. The national average is 38 cents more and the Oregon average is $1.06 more than a year ago. This is the largest year-over-year increase in the nation, followed by Alaska (+$1.03), Nevada (+$1.01), Washington (+95 cents), Hawaii (+87 cents), and California (+83 cents). Colorado (+1/10th of a cent) has the smallest year-over-year increase. Georgia (-12 cents) is the only state with a year-over-year decrease.

West Coast

The West Coast region continues to have the most expensive pump prices in the nation with all seven states in the top 10. This is typical for the West Coast as this region tends to consistently have fairly tight supplies, consuming about as much gasoline as is produced. In addition, this region is located relatively far from parts of the country where oil drilling, production and refining occurs, so transportation costs are higher. And environmental programs in this region add to the cost of production, storage and distribution.

Refinery issues in California in September and October exacerbated the situation, creating extremely tight supplies and causing pump prices in this region to skyrocket.

| Rank | Region | Price on 11/8/22 | ||

| 1 | California | $5.45 | ||

| 2 | Hawaii | $5.21 | ||

| 3 | Nevada | $4.96 | ||

| 4 | Oregon | $4.83 | ||

| 5 | Washington | $4.82 | ||

| 6 | Alaska | $4.74 | ||

| 7 | Illinois | $4.29 | ||

| 8 | Idaho | $4.29 | ||

| 9 | Arizona | $4.26 | ||

| 10 | Michigan | $4.19 |

As mentioned above, California is the most expensive state for the ninth consecutive week with Hawaii, Nevada, Oregon, Washington, and Alaska rounding out the top six. Arizona is ninth. Oregon is fourth for the second week in a row.

Several West Coast states have the largest weekly drops in the nation: Oregon (-11 cents), Alaska (-9 cents), California (-9 cents), and Washington (-9 cents). Arizona (-3 cents), Nevada (-1 cent) and Hawaii (-3/10th of a cent) are also seeing week-over-week declines.

The refinery utilization rate on the West Coast rose from 81.1% to 84.7% for the week ending October 28. The rate has ranged between about 76% and 90% in the last year.

According to EIA’s latest weekly report, total gas stocks in the region ticked up from 26.16 million bbl. to 26.20 million bbl.

Oil market dynamics

Crude prices spiked at the end of last week after the dollar dropped in value. Commodities such as crude oil are priced in U.S. dollars. A weaker dollar can increase demand for oil by making it more attractive to investors using other currencies. Moreover, the price of oil rose after the EIA reported that total domestic crude stocks had declined by 3.1 million bbl. However, for this week, crude oil prices could face headwinds if market concerns regarding the likelihood of a recession persist. If economic growth stalls or reverses course, crude demand is likely to follow suit alongside prices.

At the close of Friday’s formal trading session, WTI increased by $4.44 to settle at $92.61. At the close of Monday’s formal trading session, WTI lost 82 cents to close at $91.79. Today crude is trading around $91, compared to $88 a week ago. Crude prices are about $10 more than a year ago.

Drivers can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad and Android. The app can also be used to map a route, find discounts, book a hotel and access AAA roadside assistance. Learn more at AAA.com/mobile.