The ultimate guide to debt consolidation

Inside Creative House // Shutterstock

The ultimate guide to debt consolidation

A couple consults with a finance professional while looking at a set of documents.

Debt consolidation is a strategy for managing debt that involves using a new loan, credit card or payment plan to pay off your existing debts. When you consolidate, you’ll roll multiple existing accounts into one new account. Ideally, this will make your finances more manageable.

Prosper explains that debt consolidation can potentially help if you want to reduce the number of your monthly debt payments, secure lower interest rates, reduce the total amount you pay each month, or eliminate creditor fees. Consolidating debt can also help you end a relationship with a bad creditor, assuming you pay off the remaining balance you owe them.

There are multiple products you can use to consolidate your debt, including balance transfer credit cards, personal loans, and home equity loans. For each of these products, you’ll need to qualify based on the creditor’s requirements for your credit history, income, and other factors.

The best types of debt to consolidate

In particular, debt consolidation is a good strategy when it comes to paying off high-interest accounts like credit cards. That’s because consolidating your debt can potentially move your outstanding balance to a loan with a much lower interest rate.

As of May 2024, the average APR for a credit card is over 21.57%, while a personal loan has an average APR of around 11.92%.

Types of debt to avoid consolidating

You’ll generally want to avoid consolidating low-interest debt, like mortgages and car loans. These types of loans, which are secured by collateral, usually have relatively low interest rates.

Additionally, mortgage lenders may offer hardship assistance to borrowers struggling with their mortgage debt.

Debt consolidation isn’t usually beneficial for managing debt with a lot of payment flexibility either, like federal student loans and medical bills.

Most federal student loans are eligible for income-driven repayment plans, sometimes with payments as low as $0. If your student loan isn’t eligible for this type of repayment plan, you might consider consolidating through the Department of Education (more on this below), rather than through a private lender.

With medical bills, you can avoid the need for consolidation by applying for free or discounted charity care, negotiating the bill down to an amount you can afford or setting up an interest-free monthly payment plan.

7 ways to consolidate debt

There are several ways to consolidate debt, but each one has its own benefits and requirements. Here’s a look at Prosper’s top recommendations:

- Personal loan

Personal loans are sometimes referred to as “debt consolidation loans,” since you can use them for debt consolidation. Whether or not you qualify depends on the lender’s requirements for your credit and income. These loans can be a good option for credit card consolidation since they usually carry much lower interest rates than credit cards. However, rates generally aren’t as low as secured debt, and you may have to pay an application fee or origination fee to the lender.

- Home equity loan (HELoan) or line of credit (HELOC)

HELoans and HELOCs allow you to tap into your home equity to pay off old debt. But you’ll have to use your home as collateral. According to Senior Assistant Director of Financial Wellness at University of Oregon, Gilbert Rogers, “Home equity loans usually offer a lower interest rate due to the asset backing the loan (your home).” He warns borrowers, however, that “If your finances are unstable then you risk the loss of your home.” Other drawbacks to HELOCs include rising interest rates and loss of home equity.

- Reverse mortgage

Similar to home equity loans, a reverse mortgage or home equity conversion mortgage (HECM) lets you cash out some of your home equity. But these loans usually come at a much higher cost than HELoans and HELOCs, and they’re only available to homeowners 62 or older. You don’t have to make monthly payments on a reverse mortgage, but you may have to pay origination fees up to $6,000, plus closing costs and a mortgage insurance premium, and the balance on the loan will increase as interest and fees accrue each month. Then, when you move or pass away, the home will likely have to be sold to pay off the debt.

- Direct Consolidation Loan

If you have multiple student loans from the federal government, you might consider applying for a Direct Consolidation Loan through the Department of Education. It can take about six weeks for applications to be processed. If you qualify, you can potentially reduce your monthly payment amount, get into a fixed interest rate, and gain access to an income-driven repayment plan or federal loan forgiveness program, all at no additional cost to you.

- Balance transfer credit card

A balance transfer credit card can help you pay down debt more aggressively, since it comes with an introductory 0% APR period—usually for one year or more. Just beware that if the card doesn’t have 0% purchase APR, you’ll be charged interest on your purchases. You’ll likely be charged a 3% to 5% balance transfer fee on the amount you consolidate as well, and the card may have an annual fee.

- 401(k) loan

Taking out a 401(k) loan may seem the same as pulling money out of your savings, but it’s far more expensive. Yes, taking money from your 401(k) can help you consolidate debt, but it converts your retirement savings into even more debt. Not only will you have to repay the money, but you may have to pay taxes on the loan, plus a 10% tax on the amount you borrow if you’re under the age of 59.5, and you may have to repay the full loan balance if you lose or leave your job. Plus, you’ll lose out on some of the interest you can earn before retirement.

7. Borrow from friends or family

Not everyone has a loved one with cash to spare. If you do, it could be worth asking them for a loan to help you consolidate debt. Unlike some other solutions, you won’t have to qualify for the loan based on your credit scores, and you probably won’t be asked to pay interest or any fees. To seal the deal, however, it helps to be direct about when and how you’ll pay the money back. Just like a loan from a business, you may want to put the agreement in writing.

Debt consolidation requirements

Like with most financing, creditors have different requirements to qualify for their debt consolidation products. But they tend to follow similar guidelines. Here’s what they’re typically looking for:

Credit scores

When it comes to getting approved for balance transfer credit cards and debt consolidation loans, your credit scores are crucial. “Be mindful of your credit scores because they’re what most lenders use to set your interest rate,” says Jackie Cummings Koski, personal finance educator and consultant.

In general, the higher your score is, the more likely you are to qualify for higher limits on credit cards, or for larger loan amounts, with lower APRs. You can also improve your chances of qualifying for a loan or credit card by applying with a co-signer.

Employment history

Creditors will look at income and employment to determine what you can afford and how much credit you qualify for. For example, you’ll have a better chance of being approved for a loan (whether for debt consolidation or not) if you have a steady source of income that enables you to repay the loan.

Debt and income

Lenders might look at your debt-to-income ratio (DTI), which is calculated by adding up all of your minimum monthly debt payments and dividing that figure by your gross monthly income. You can use this formula to calculate your DTI:

Debt-to-Income (DTI) Formula

DTI = (Monthly debt payments/Income) x 100

For example, let’s say your minimum monthly debt payments add up to $2,000 and your gross monthly income is $5,000. Your DTI would be calculated like this:

Sample DTI calculation

Step 1: DTI = ($2,000/$5,000) x 100

Step 2: DTI = ($0.40) x 100

Step 3: DTI = 40%

Having a low DTI means you have high income compared to your debt, and therefore you have a better chance of being approved for a loan. Many lenders won’t approve you if your DTI is above 43%, according to Equifax. There’s a chance you may need to find another way to pay down debt, or increase your income, before you can qualify for a loan.

Home equity

For HELoans and HELOCs, your home equity will also come into play. In other words, your home should be worth more than the balance you owe against it. You’re more likely to qualify for one of these products if you’ve paid off at least 15% to 20% of your home’s value before applying.

Factors to consider when choosing a debt consolidation option

Finding the best debt consolidation option can take some work, especially if you’re looking to bring down your monthly expenses.

To calculate the cost of debt consolidation and find out if it will truly save you money, you’ll have to compare the following information across lenders and products:

- APR

- Length of repayment

- Cost of interest-only payments (if applicable)

- Lender fees, including origination fee, application fee, closing costs or otherwise

- Credit score requirements

- Minimum and maximum loan amount or credit limit

Don’t worry if consolidating seems overwhelming. It’s just basic math. By carefully comparing the numbers and selecting the appropriate product, consolidating debt could potentially save you thousands of dollars in interest charges and fees.

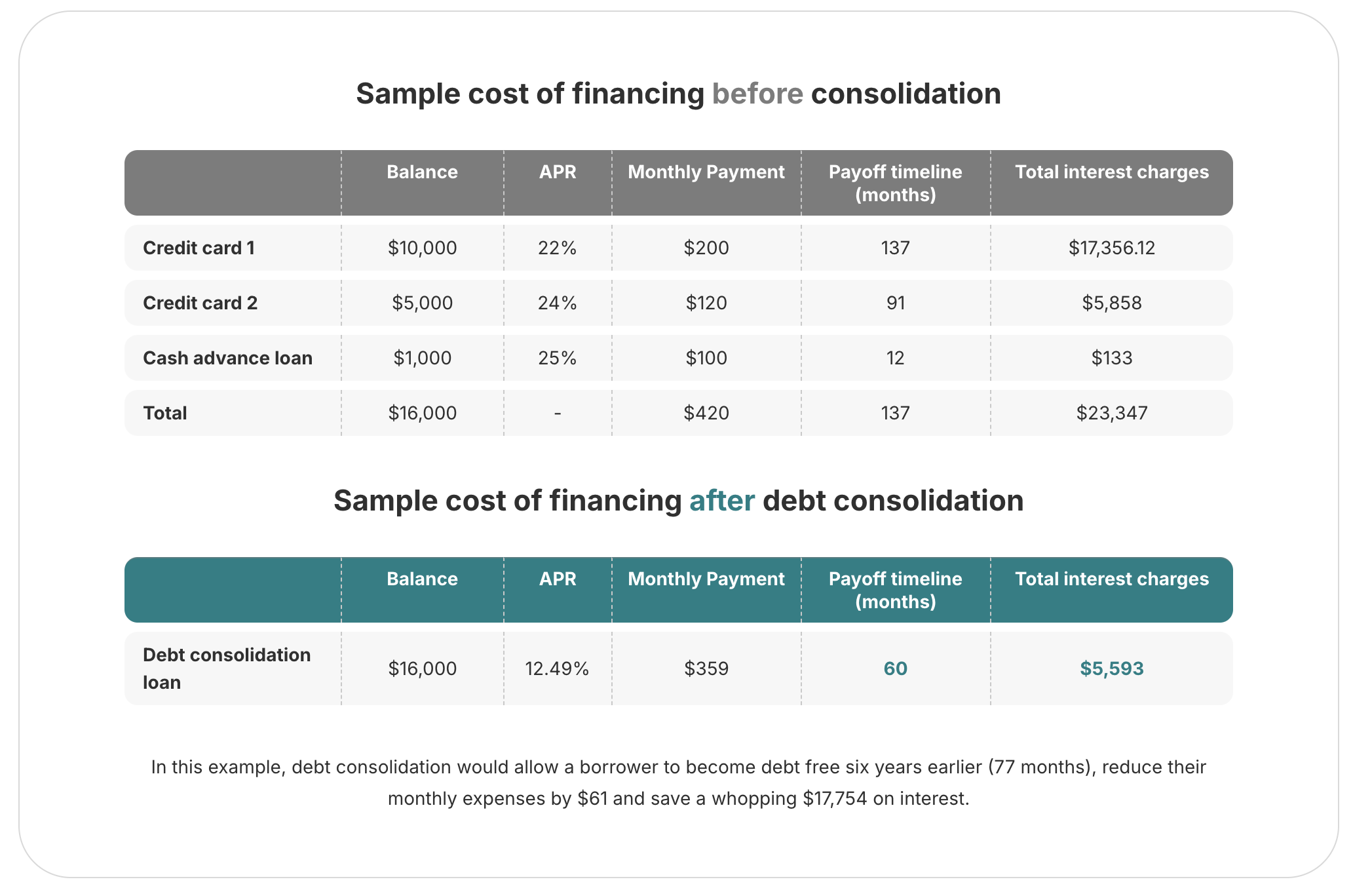

Here’s an example of how much it could cost to pay off debt, before and after consolidating

![]()

Prosper

How to consolidate your debt

Image showing a sample cost of financing before and after consolidation.

If you’re ready to pursue debt consolidation, be sure to proceed with care. By taking these strategic steps to consolidate, you can avoid headaches and maximize your savings:

- Define your goal

Before you start shopping around, get clear on what you’re hoping to accomplish. “You should always take the time to outline goals for debt consolidation and ensure they’re being achieved through the process (i.e., savings, simplification, etc.),” recommends Rogers.

- Calculate your debt

Add up the total amount of debt you want to pay off, that way you’ll know how much financing to look for.

- Review your credit

Pull your free credit reports to see if there are any errors that need to be fixed or other issues that need to be improved. If you have a loan account with Prosper, you can view your FICO score for free. You might also have access to complimentary credit scores through your creditor(s) or through a free credit monitoring program.

- Research and compare options

Look at different types of creditors to see what they have available. Be sure to include your bank or credit union, since they may offer special incentives to customers. You can easily broaden your search by trying reputable online lenders, too.

- Get prequalified

Getting prequalified for a loan or credit card can allow you to see a rate quote from a creditor without a hard credit pull, meaning it won’t hurt your credit scores. Ideally, you’ll want to compare three or more prequalification offers to get an idea of what’s available and negotiate the best rates.

- Apply

Once you’ve honed in on the best offers, submit your applications. Be prepared to provide your contact information, proof of income and details about your debt.

- Pay your pre-existing debt

Once you receive your new credit card or loan, you’ll need to pay off your old debt accounts. You may have to pay them off yourself, or you can coordinate with the new creditor to send payments on your behalf.

- Start payments on the new account

Make a note of the due date and minimum payment required for your new account, so you can work them into your budget and stay current on the payments.

Pros and cons of debt consolidation

The benefits of debt consolidation aren’t always clear-cut, says Rogers. “Credit cards and loans are both available as debt consolidation tools, but they each come with pros and cons. For example, anytime there is an offer to consolidate debt through a loan or credit card, there will be a fee.”

Fortunately, if you choose to consolidate your debt carefully, you’re likely to experience more of these pros than cons:

Pros

- Savings: Consolidating into a lower APR can save you money on interest and other finance charges.

- Fewer payments: When you use debt consolidation to pay off multiple accounts, you roll all of the payments into one and have fewer accounts to monitor and manage.

- Improve your credit: Consolidating can help you pay off debt faster, accelerating growth in your credit scores.

- Spread out payments: Consolidation can also allow you to extend the length of your debt repayment, bringing down your total monthly payment amount and helping you balance your budget.

- Avoid debt settlement: Consolidating debt can help you avoid predatory alternatives like for-profit debt settlement, which can put you at risk of everything from tanking your credit to facing legal issues, without even lowering your overall debt.

Cons

- Financing fees: Depending on the product, you may have to pay an origination fee, a balance transfer fee, closing costs, an annual fee, or other costs associated with the new financing.

- Credit requirements: Your eligibility for debt consolidation products may depend on your credit scores. Poor credit can be a roadblock.

- Prepayment penalties: Some of your current creditors may charge you a fee if you pay off your debt before the scheduled payoff date.

- Payments could increase: If you consolidate credit card debt into a loan, your monthly debt payments could increase since, unlike credit cards, loans have a set payoff date.

- Initial hit to your credit: Your credit scores may drop by a few points when you apply for a new loan or credit card, and they may drop even more if you open or close accounts due to debt consolidation.

Managing your debt after consolidation

It’s tempting to see debt consolidation as a final solution for financial problems, but keep in mind that consolidating debt won’t automatically make it go away. If you want to be debt free once-and-for-all, you may need a new approach to financial planning.

“The biggest mistake individuals make when consolidating debt is sticking to bad habits. Anytime you make a significant change in your financial situation you should sit down and reassess your habits,” Rogers suggests.

Here are some new habits to help you effectively manage your debt and move past your bills.

- Update your budget

Consolidation can change your monthly expenses. If consolidation decreased your monthly expenses and as a result you have extra cash, consider putting some of that money toward paying off your new loan early. If consolidation increased your monthly expenses, make sure to adjust other items in your budget immediately.

- Avoid new debt

Consider additional actions that can help you get out of the debt loop, like eliminating non-necessities for a few months or even longer. “My best tip for getting out of debt after consolidating is to establish a repayment plan that requires you to say ‘no’ to some of your current habits,” says Rogers. Try things like canceling subscriptions, deleting your credit card information from retail accounts and asking a friend or family member to help hold you accountable.

- Keep introductory periods in mind

If you open a balance transfer credit card, don’t forget that the 0% APR period will eventually expire. If you don’t have a plan for paying off the balance at that time, your monthly payments and interest charges could skyrocket.

- Use the debt avalanche

You can save money on debt payments and build positive momentum by using the debt avalanche method. With this method, you’ll use any surplus cash you have to pay extra toward your highest interest debt. Once that account is paid off, you’ll roll the funds over to the next highest debt until all of your debts are eliminated.

- Increase payments when possible

If your income increases, or you get a bonus or a tax refund, use the extra money to increase your debt payment and not your spending.

- Schedule a payoff date

Calculate your debt payoff date based on your new payment schedule. Then add the date to your calendar. If you hit your goal ahead of schedule, great!

- Track your progress

Check in on your debt balances regularly, and be sure to acknowledge when things are moving in the right direction. “Monitor your progress and celebrate the milestones along the way,” suggests Cummings Koski. “Beyond your finances, think about how you feel as you’re conquering your goal of getting out of debt,” she says. Rogers suggests setting goals and, as you achieve them, setting new ones. “This will help you remain on the path to paying off debt,” he says.

- Start an emergency fund

Lay the foundation for a debt-free future by setting money aside for emergencies on a regular basis, even if it’s just $25 per paycheck. “This emergency fund could help you out of a bind and possibly help you avoid taking on additional debt,” says Cummings Koski.

Is debt consolidation right for you?

For some people who are struggling with debt, debt consolidation can be a great tool. That’s because consolidation is a strategy that can speed up your journey to becoming debt free, whether by reducing interest charges, eliminating financing fees or lowering your overall monthly bill payments.

But debt consolidation isn’t right for everyone. To consolidate, you’ll need to qualify for either a new balance transfer credit card, a loan, or a debt management plan based on factors like your credit scores. Even if you qualify, however, there’s no automatic guarantee that consolidating is the best solution.

As Rogers points out, no one has to navigate this stressful and confusing situation alone. Whether you’re completely overwhelmed with debt, or you just need a few quick tips, a certified credit counselor can offer professional guidance on the options that make sense for you.

Ultimately, you’ll need good financial habits to help you get out of debt and avoid getting back into it in the future. Rogers says that, regardless of whether or not you consolidate, you’ll need to cut back on expenses and outline your specific goals and targets for paying off debt if you really want to improve your finances.

This story was produced by Prosper and reviewed and distributed by Stacker Media.