Millions of Americans don't have bank accounts. Here's where they live.

Photo Illustration by Stacker // Shutterstock

Millions of Americans don’t have bank accounts. Here’s where they live.

Most financial experts agree that the best time to start using a credit card is 18, as long as one is equipped with the financial education to tackle the responsibility of taking on debt. The sooner someone can begin building a history with banks, the better.

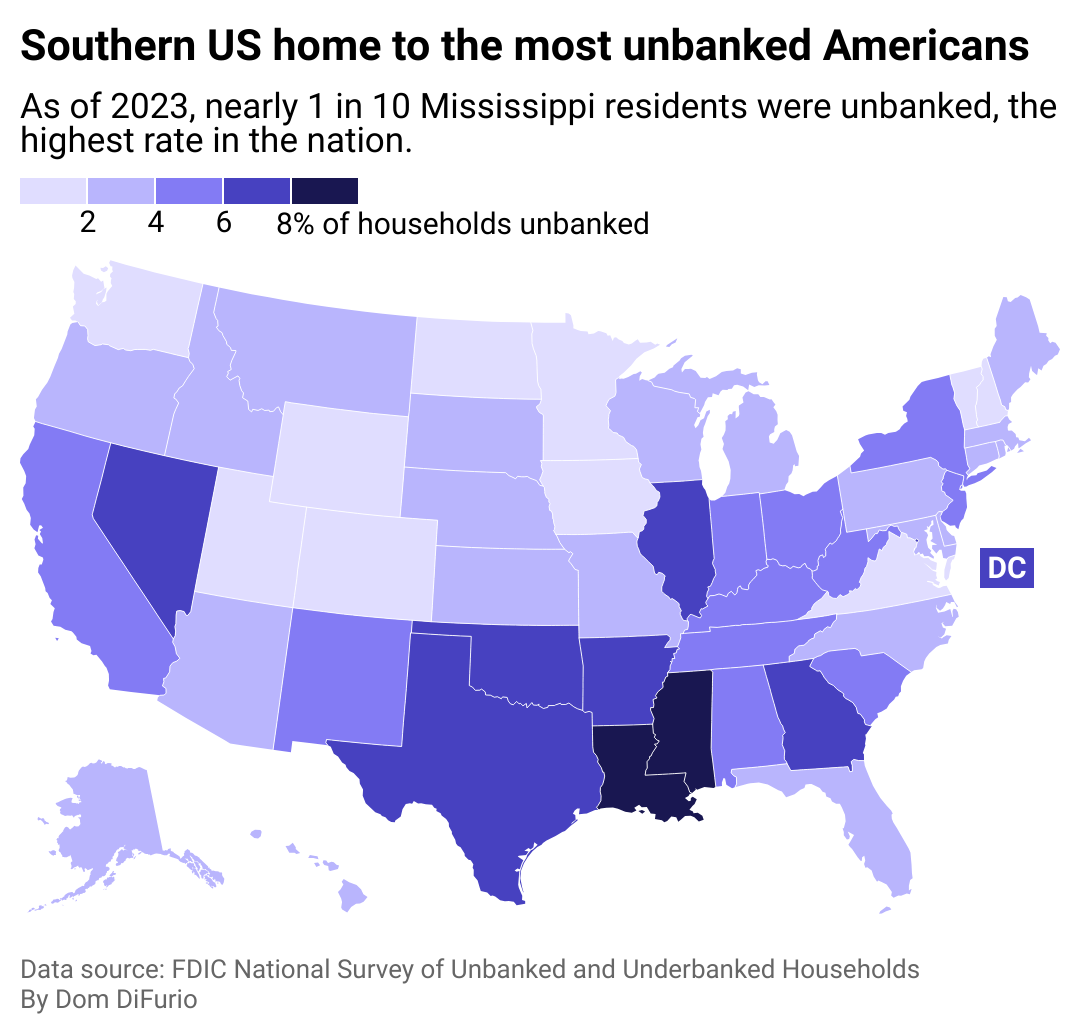

In a country where taking part in the banking system is a necessary tool for economic opportunity, about 1 in 25 Americans still don’t participate.

Who are they, and why don’t they manage their finances with banks? These adults who don’t use traditional credit cards, savings, or debit accounts are known as the “unbanked.” Spokeo analyzed data from the Federal Deposit Insurance Corporation to illustrate where in the U.S. the most unbanked Americans live.

About 4.2% of Americans were considered unbanked in 2023, according to survey data the FDIC released in November. Not using banking services can be expensive and time-consuming. Researchers at the Federal Reserve have referred to being unbanked as “financial exclusion.”

Access to banking services can provide the resources to turn ideas into businesses. Banks offer accounts for storing wages and building financial security through savings. They also lend money to entrepreneurs, which creates jobs and benefits communities. Living without access to the services banks provide means consumers are left to deal with more predatory financial institutions, including payday lenders, check cashing, and title loan companies, where consumers pay much higher interest rates than they would if they used banks.

Single mothers are more likely to be unbanked than single fathers, but single men without families are more likely to be unbanked than single women without families. There is also a geographic difference in unbanked rates, with people living outside of dense metropolitan areas less likely to use banking services, though that gap has narrowed in the past several years.

Since the 1980s, the share of unbanked individuals in the U.S. has declined. Most recently, it’s fallen from 5.4% in 2019 to 4.2% in 2023—a sign that Americans continue to recognize the banking system’s value. Still, in an era where nearly anyone can trade stocks in seconds on their cell phone, millions of Americans are still missing out on the value of participating in the banking system.

Education level, race and ethnicity, and income are the biggest factors determining whether a person is more likely to use banking services. Differences in unbanked rates between Black or Hispanic households and white households exist at every income level, according to the FDIC.

![]()

Spokeo

A disadvantage inextricably linked to race

An FDIC survey of unbanked Americans in 2023 found that the most common reason cited for not having a bank account was an inability to meet minimum balance requirements. Banks typically require customers to deposit between $25 to $100 to open a checking or savings account, according to the Consumer Financial Protection Bureau. Survey respondents said they also do not trust banks, and are concerned about the fees associated with using them.

However, there are other reasons besides trust that keep Americans excluded from the financial system. Some avoid banks to increase their sense of privacy. Others reported that bank locations and hours of operation were inconvenient.

States with the largest populations of unbanked individuals are also states with significant Black populations that have historically been intentionally excluded from participating in the banking system by racist policies and practices.

Black-owned banks originated during the post-Civil War era to serve communities excluded from the mainstream financial system. But banks serving majority Black communities have been on the decline over the past two decades, severely limiting access to financial services. Today, majority Black and Latino or Hispanic neighborhoods have fewer choices in banks to go to than majority white neighborhoods, meaning they live in a less competitive environment for banks and are potentially subject to higher service rates, according to a 2021 Brookings Institute analysis.

Digital banking has exploded over the past decade and promises to eliminate many barriers to using financial services, like lack of transportation. However, there are still people who rely on physical banking. FDIC surveys have shown that low-income Americans and those with lower education levels are more likely to use in-person banking services—something banks have divested from as they move more of their operations online.

One of the more significant events that has pushed more Americans toward opening bank accounts in recent history had to do with extreme necessity: the government stimulus checks issued during the COVID-19 pandemic. Almost half of unbanked Americans who began using banks in that period said the stimulus was a reason they opened an account, according to the FDIC.

Federal agencies have tried to increase the population of banked Americans, but a 2022 report from the Government Accountability Office found that the success of these efforts is difficult to judge. Its recommendations that the FDIC and other agencies adopt clear measurement systems for the impact of public awareness campaigns and other efforts have yet to be implemented.

Story editing by Carren Jao. Additional editing by Kelly Glass. Copy editing by Kristen Wegrzyn.

This story originally appeared on Spokeo and was produced and

distributed in partnership with Stacker Studio.