How health care spending varies by occupation

Canva

How health care spending varies by occupation

A stethoscope sitting on top of a pile of $20 bills.

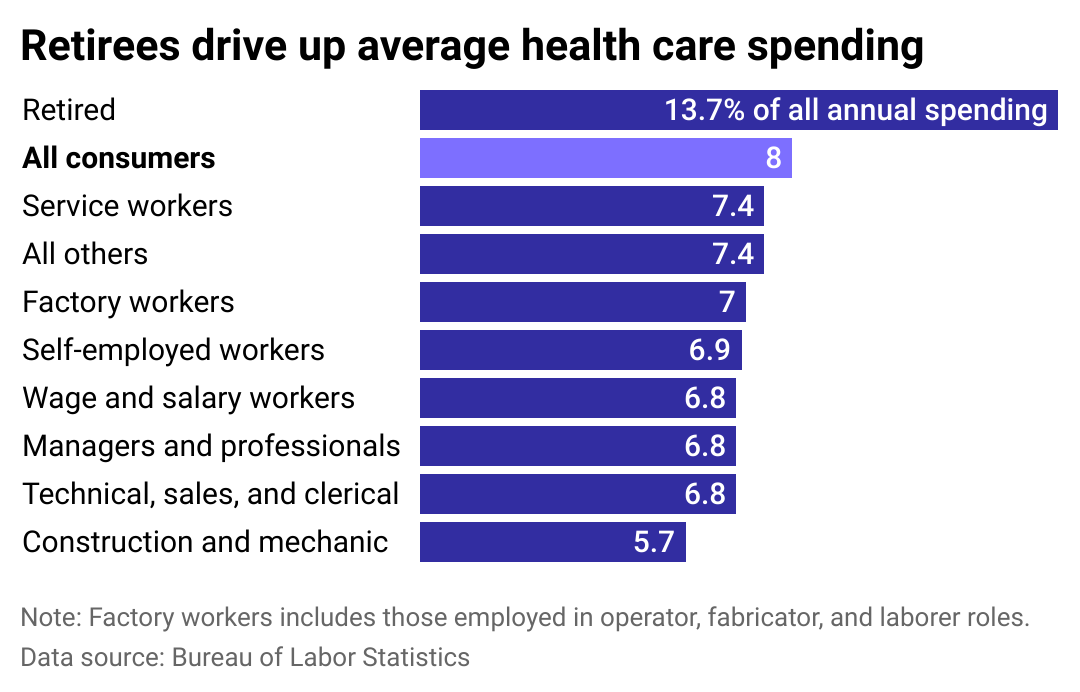

The American health care story is essentially a tale of the “haves” and “have-mores.” Managers and professionals, as well as all wage and salary workers, pay 6.8% of their income toward health expenses, including prescription drugs, health insurance, medical services, and medical supplies. Construction workers and mechanics, however, despite their physically rigorous professions, spend less of their household budgets on their health at 5.7%.

To get these numbers, Incredible Health used data from the Bureau of Labor Statistics to examine health care spending across different work sectors.

It may seem that spending more on health expenses may be a bad thing. But health care only works when you can use it. Workers in careers with the best, employer-sponsored health insurance and with the best benefits packages of sick days, personal leave, and salary appear to spend more because they utilize health care more—and can afford to do so. Meanwhile, the oldest Americans, retirees, spend double (nearly 14%) what the average worker does on expenses related to health care.

Regardless of your station in life, premiums for employer-sponsored insurance family plans are going up, and in some cases, workers are shouldering more of that cost.

![]()

Incredible Health

Health care makes up less than 8% of overall spending for most people

Bar chart showing retirees spend about 14% of overall spending on health expenses, compared to under 8% for most other worker categories.

It shouldn’t be a surprise that retirees are spending the most on health care. In 2023, a 65-year-old single person may need $157,500 in after-tax savings to pay for retirement health care costs, according to a Fidelity Retiree Health Care Cost Estimate. The average 65-year-old retired couple may need $315,000.

Outside of Medicare and insurance, people can plan for retirement health expenses by opening a health savings account. Commonly referred to as an HSA, these accounts allow workers to put aside pre-tax money to spend on qualified medical expenses. The untaxed dollars may lower out-of-pocket health care costs such as copays, deductibles, and coinsurance.

Another way to plan for health care expenses is by purchasing long-term care insurance. While it has some shortfalls—and it is not a substitute for health care—it can cover expenses that health insurance will not. Services such as hiring help for bathing, dressing, or care for Alzheimer’s disease may be covered by long-term care insurance.

Incredible Health

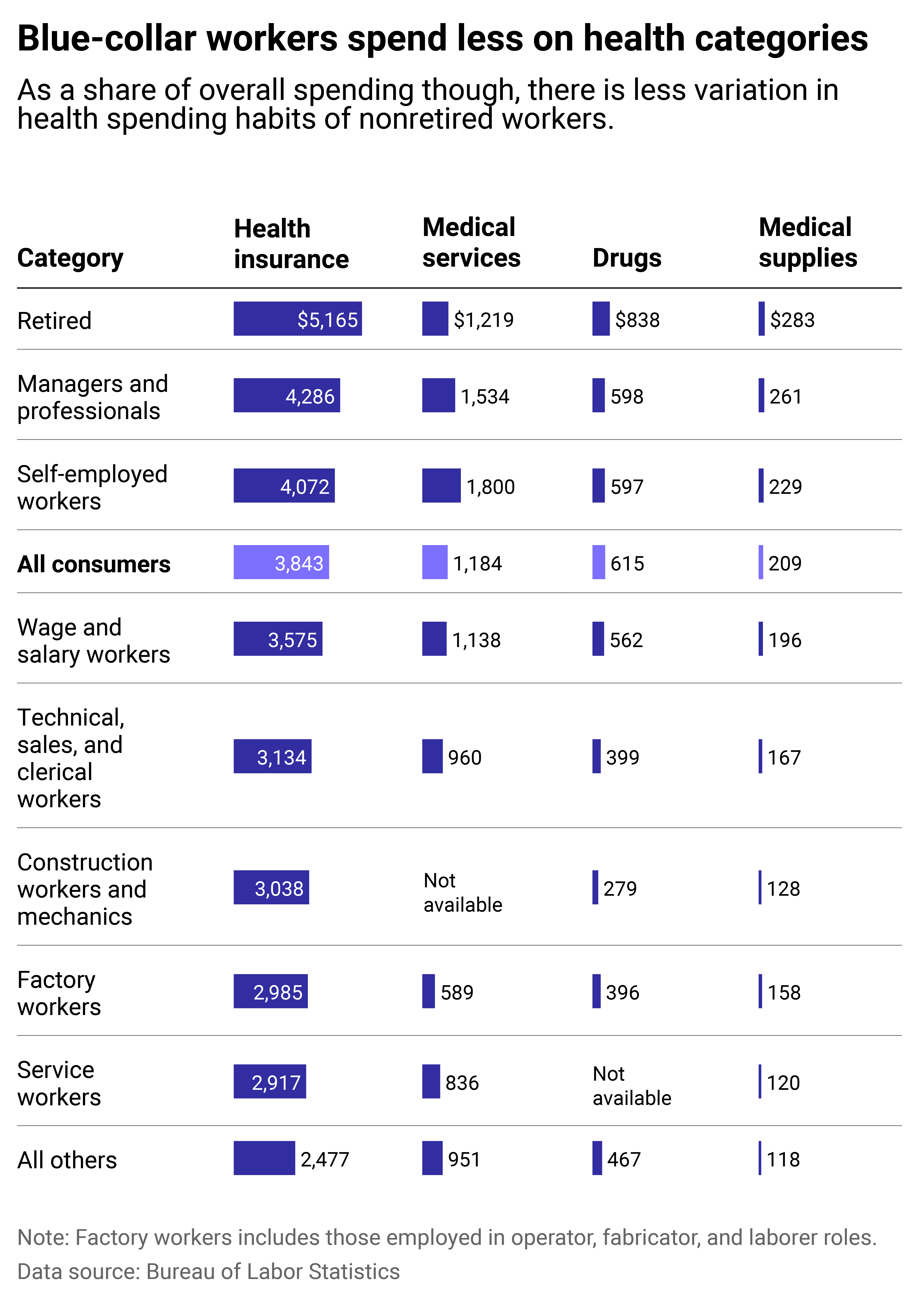

Insurance is the most expensive health expense

Table showing blue collar workers spend less dollars on health expenses. Other than retirees, health expenses as a share of overall spending is consistent across most workers.

Blue-collar workers spend fewer dollars per year on health expenses. However, it’s important for blue-collar workers to have adequate health care, pay, and sick days because they tend to work longer and have worse health conditions than white-collar workers, according to a 2011 Columbia University study.

Adults who don’t have adequate—or any—health insurance are three times more likely to say they haven’t visited a health clinic or medical doctor in a year, according to a KFF report, The Uninsured and the ACA: A Primer – Key Facts about Health Insurance and the Uninsured amidst Changes to the Affordable Care Act.

Those stats may explain the plight of construction workers. Fewer than 43% of construction workers in the South are offered health insurance by their employer, according to the Build a Better South: Construction Working Conditions in the Southern U.S. study by the Workers Defense Project, an organization that helps low-wage, immigrant construction workers in the construction industry. What’s more, 78% lacked paid sick time, the study found, making it harder to even leave work to see a doctor without risking a cut in pay. Affordability may also be a factor; even though more than 80% of the workers in the Build a Better South study reported working overtime, 36% struggled to pay for essentials such as food or rent.

According to the KFF report, “19% of uninsured adults said they delayed or did not get a needed prescription drug due to cost, compared to 14% with public coverage and 6% with private coverage.“

Story editing by Ashleigh Graf. Copy editing by Tim Bruns.

This story originally appeared on Incredible Health and was produced and

distributed in partnership with Stacker Studio.