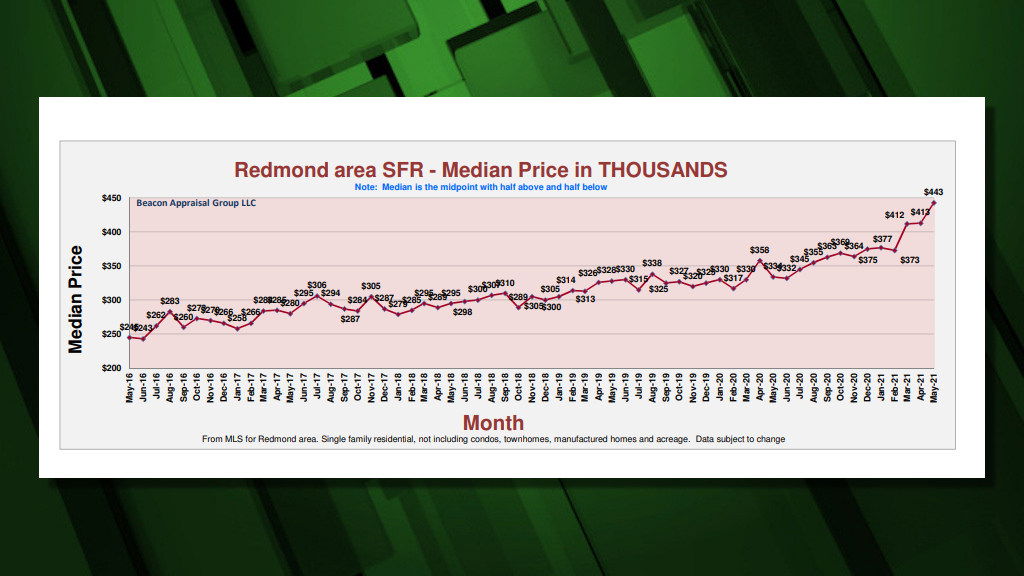

Bend median home sales price drops from record in May, while Redmond rises to new record

REDMOND, Ore. (KTVZ) – Bend’s median home sales price dropped $23,000 in May from the record $651,000 set in April, while Redmond’s went the other way, jumping $30,000 in a month to a record $443,000, Beacon Appraisal Group reported Wednesday.

Here's the monthly summary by appraiser Donnie Montagner:

National housing inventory levels increased slightly in April 2021 to 4.4 months, the highest level since May of 2020, which was 5.3 months (according to Federal Reserve Economic Data - FRED). The same source shows average interest rates ticked up to 2.99% on 6/3/2021 for a 30-year fixed rate mortgage.

SFR (single-family residence) inventory levels in Bend and Redmond scarcely increased in May 2021. Heavy competition between buyers and lack of supply are continuing to fuel the increases in sale prices.

Bend SFR shows a decline in median sale price in May 2021 when compared to the high median sale price of $651,000 in April 2021. It is common for the Bend SFR market to show significant increases and declines in median sale prices due to the wide variations in SFR products within the market area. This most recent decline does not correlate with a declining market, as supply and demand components are basically unchanged. Strong demand, coupled with very low inventory and short marketing times, all point to a very strong seller's market.

Redmond SFR had a spike in median sale price to $443,000, as there were a significant number of sales in the $500,000 and higher price range, nearly 30% of all SFR sales.

The impending termination of the foreclosure moratorium raises questions as to how the market will be impacted if/when the moratorium comes to an end later this month. Given the minimal level of inventory in Central Oregon (around a half-month supply) and the high demand, it is difficult to foresee how these potential foreclosures will impact the market, at least in the short run.

The full June report (May stats) can be found at: https://beaconappraisal.net/site/wp-content/uploads/2021/06/BEACON-REPORT-June-2021.pdf