State sending nearly 700K letters advising of possible new business tax impact

Undetermined number of recipients likely have no cause to worry

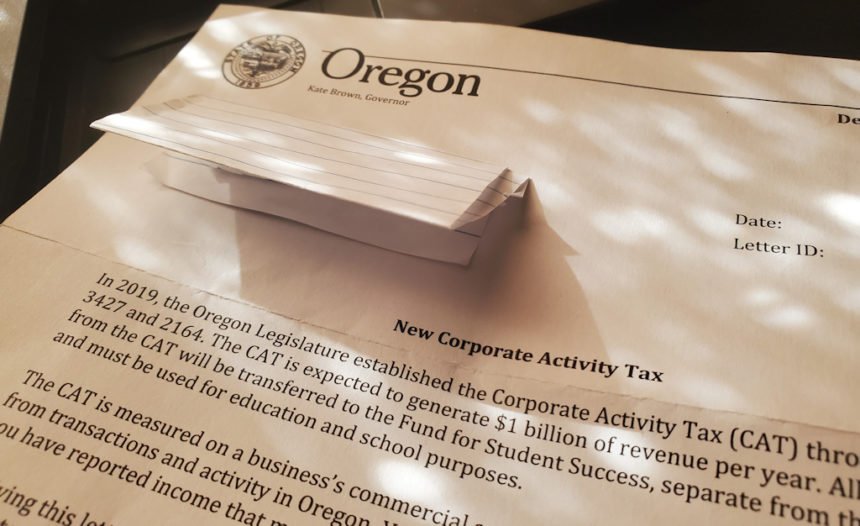

BEND, Ore. (KTVZ) -- Nearly 700,000 Oregon business and personal taxpayers are getting letters in the mail from the Oregon Department of Revenue, advising they could be subject to the state's new Corporate Activity Tax.

However, an undetermined number of recipients likely don't owe the tax, which lawmakers approved last year and is expected to raise about $1 billion a year for added school funding.

The letter indicates it was sent "because in the past two years you have reported income that may be considered commercial activity."

But it goes on to state, "Receiving this letter does not mean the department has or has not determined that you will be subject to this tax."

About 450,000 initial letters were sent at a rate of 50,000 a week, beginning in October, department Public Information Officer Robin Maxey said Friday.

The first set of letters went to all business entities that have filed Oregon returns in 2017 and/or 2018, Maxey said. Those included the four different kinds of corporation returns, partnership returns, composite returns, personal income tax returns with business income, and others.

Another 236,000 letters are now being sent to people whose 2017 and/or 2018 state tax returns included a:

- Schedule C for profit or loss from a sole proprietorship;

- Schedule E for supplemental income and loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, real estate mortgage investment conduits, and other categories; and

- Schedule F for profit or loss from farming.

The letters, Maxey said, "are simply a notice to taxpayers who, in tax years 2017 and/or 2018, have reported income that may be considered commercial activity. As the letters say, the department has made no determination that anyone who received the letter will have a CAT liability."

If a taxpayer believes they received the letter in error, they can call 503-945-8005 and a department representative can see what information in their 2017 and/or 2018 return resulted in them receiving the notice.

The law that established the Corporate Activity Tax sets a series of thresholds:

- Once a business reaches $750,000 in commercial activity, it is required to register for the CAT within 30 days. Registration is available through Revenue Online on the department’s website at www.oregon.gov/dor.

- When a business reaches $1 million in commercial activity, it is required to file a CAT return.

- Business entities with $1 million or more in taxable commercial activity (after subtractions) have a CAT liability of $250 plus 0.57 percent of taxable commercial activity over $1 million.

Business entities or individuals with business income with less than $750,000 in commercial activity are not subject to the CAT.

The CAT page on the Department of Revenue’s website has a wealth of information on the CAT, including extensive guidance in a long list of frequently asked questions, Maxey said.

The Department of Revenue is hosting meetings across the state next month to give information to business taxpayers and tax professionals about the rules for the new tax. The tour kicks off in Bend on Monday, March 2, with a 6-7:30 p.m. meeting at COCC.