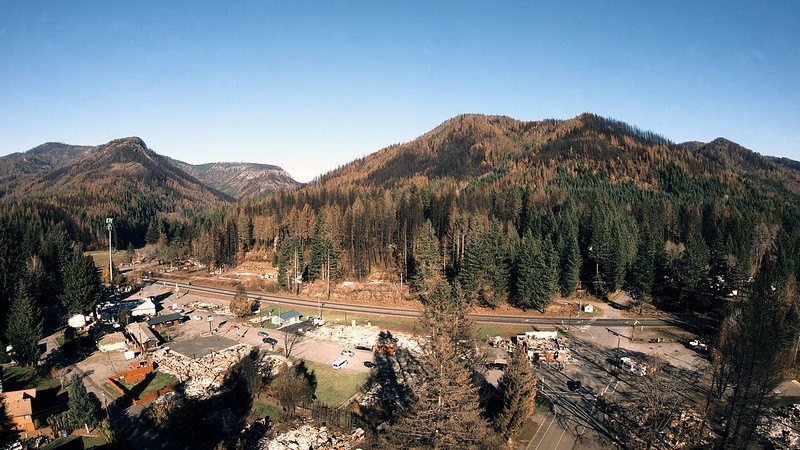

Chavez-DeRemer backs House-passed bill to provide retroactive tax relief for wildfire victims

WASHINGTON (KTVZ) – The U.S. House recently passed the Federal Disaster Tax Relief Act with broad bipartisan support. Rep. Lori Chavez-DeRemer (OR-05) voted in favor of the legislation, which would provide tax breaks to wildfire victims who were granted relief payments any time after December 2019.

Specifically, if the bill passes the U.S. Senate, it would retroactively exempt qualified victims from having to pay federal income tax on compensation for losses that were not covered by insurance.

“The 2020 Labor Day wildfires wreaked havoc on our communities, taking lives, destroying homes and burning thousands of acres," Chavez-DeRemer said. "While I continue working to advance common-sense legislation that will deter wildfire risks, it’s important to ensure Oregonians impacted by devastating fires are granted relief to help our communities build back with strength and resilience.

"Even though several years have passed, I continue to hear from constituents who need more assistance. That’s why I was proud to support the Federal Disaster Tax Relief Act, which would give a much-needed break to survivors who have already endured so much,” she added.

The Federal Disaster Tax Relief Act would provide income tax relief to victims of federally declared wildfire disasters. It specifically applies to relief payments received after Dec. 31, 2019. Full text of the bill is available HERE.