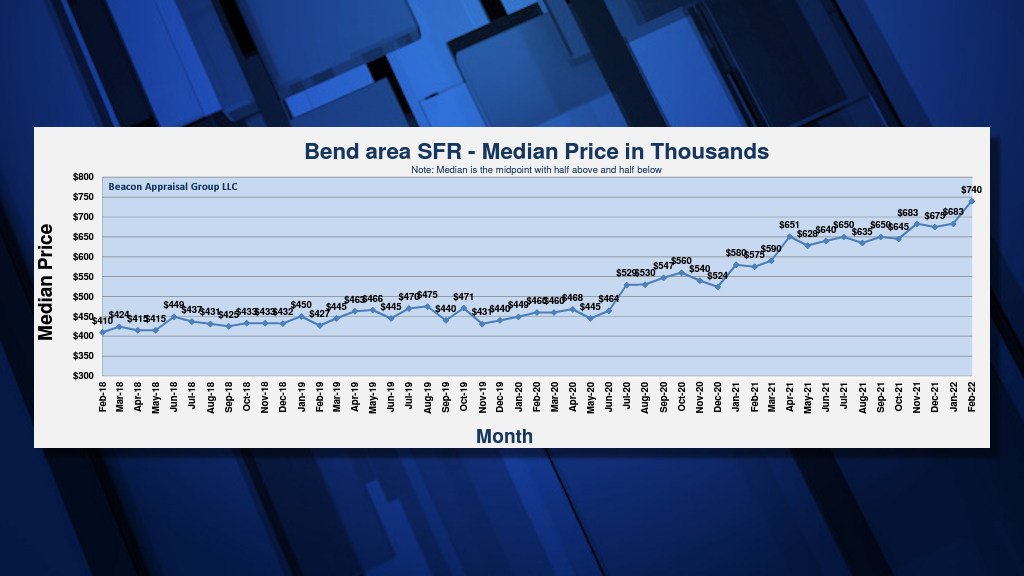

Hotter than ever: Bend median home sales price soars $57,000 in February, hits $740,000

(Update: Average Bend home sale price is even higher -- $879,000)

REDMOND, Ore. (KTVZ) -- Gas prices aren't the only thing zooming fast into record territory on the High Desert: Bend's median home sales price soared $57,000 in February alone to smash the record and reach $740,000, Beacon Appraisal Group reported Tuesday.

The inventory “remains less than a half-month supply,” appraiser Donnie Montagner said, “and there was a significant increase in the number of new (building) permits," jumping from 37 in January to a summer-like 79 new permits last month.

“In addition to market appreciation, about 64 sales were over $769K,” Montagner said. “The high number of sales in the $769K and higher (level) pushes the median upwards.”

How about Bend's average home sales price? That's even more troubling, if one is concerned about housing affordability.

"Due to the high volume of sales in the $769K and higher (category) last month, the shift of the mean (average) skews more than the median," Montagner said. "For example, the average in February was $879K."

In Redmond, meanwhile, the median home sale price dropped slightly, from January's record $500,000 to $487,0000, amid a continued half-month inventory.

"The median time on the market in both Bend and Redmond was less than a week last month," Montagner said.

To check out other stats and the rest of the area's home prices, read the full Beacon Appraisal report below: