The US labor market cooled off in June, adding just 209,000 jobs

Friday’s report showed that average hourly earnings growth was unchanged at 0.4% from the month before and also unchanged at 4.4% year-over-year.

By Alicia Wallace, CNN

Minneapolis (CNN) — The US job market cooled back down in June, adding just 209,000 jobs, and fueling optimism that the economy is on course to nail that elusive soft landing of lowering inflation without triggering a recession.

The June job gains, released Friday by the Bureau of Labor Statistics, were nearly 100,000 positions below May’s stronger-than-expected showing of 306,000 and also fell below economists’ expectations for a net gain of 225,000 jobs.

It’s the lowest monthly gain since a decline in December 2020, and — excluding the losses seen during the first year of the pandemic — June’s total is the smallest since December 2019. That being said, last month’s job growth still outpaces the pre-pandemic average.

“The job growth is slowing, but I don’t actually think that’s necessarily a bad thing,” Rucha Vankudre, senior economist for labor market analytics company Lightcast, told CNN. “In some ways this is great. We’re continuing to see the soft landing that we’re hoping for.”

The unemployment rate ticked down to 3.6% from 3.7% the month before, according to the report.

US employers have now added jobs for 30 consecutive months.

In June, the overall labor force participation rate was unchanged for the fourth consecutive month at 62.6%, but more women are working than ever before. The participation rate for women between 25 and 54 years old climbed to an all-time high of 77.8%, continuing a record-breaking streak.

“In the tug of war between the labor market and the economy, there is still a push and pull, yet the labor market remains strong,” Becky Frankiewicz, president and chief commercial officer of ManpowerGroup, said in commentary issued Friday.

A long, slow cooldown

While the Federal Reserve has tried to cool the economy with 10 consecutive rate hikes, the labor market initially remained impervious to those efforts — especially when nearly half a million jobs were added in January.

Through the first half of 2023, the economy has added 1.67 million jobs, the 12th largest January to June total on record, BLS data shows.

Service industries have driven much of the job growth in recent months as sectors such as leisure and hospitality sought to claw back from the deep job losses delivered by the pandemic as well as to respond to the release of pent-up demand from consumers who had previously suppressed experiential spending.

However, since January, the pace of monthly job gains has moderated considerably from what was seen during the past two years, and April and May were even cooler than previously thought as they were revised down by 77,000 jobs and 33,000 jobs, respectively. Additionally, job growth has tailed off somewhat in leisure and hospitality.

In June, sectors such as government, as well as health care and social assistance, saw the biggest job gains: 60,000 and 65,200, respectively.

There are indications of some slowing in other industries. In June, the number of people employed part-time for economic reasons grew by 452,000 to 4.2 million, an increase that was partially reflective of people “whose hours were cut due to slack work for business conditions,” the BLS noted in Friday’s report.

More rate hikes on deck?

Fed officials have been hoping their aggressive rate-hiking campaign would bring about a slowdown in the job market, and especially in wage gains, which are viewed as a contributor to inflation.

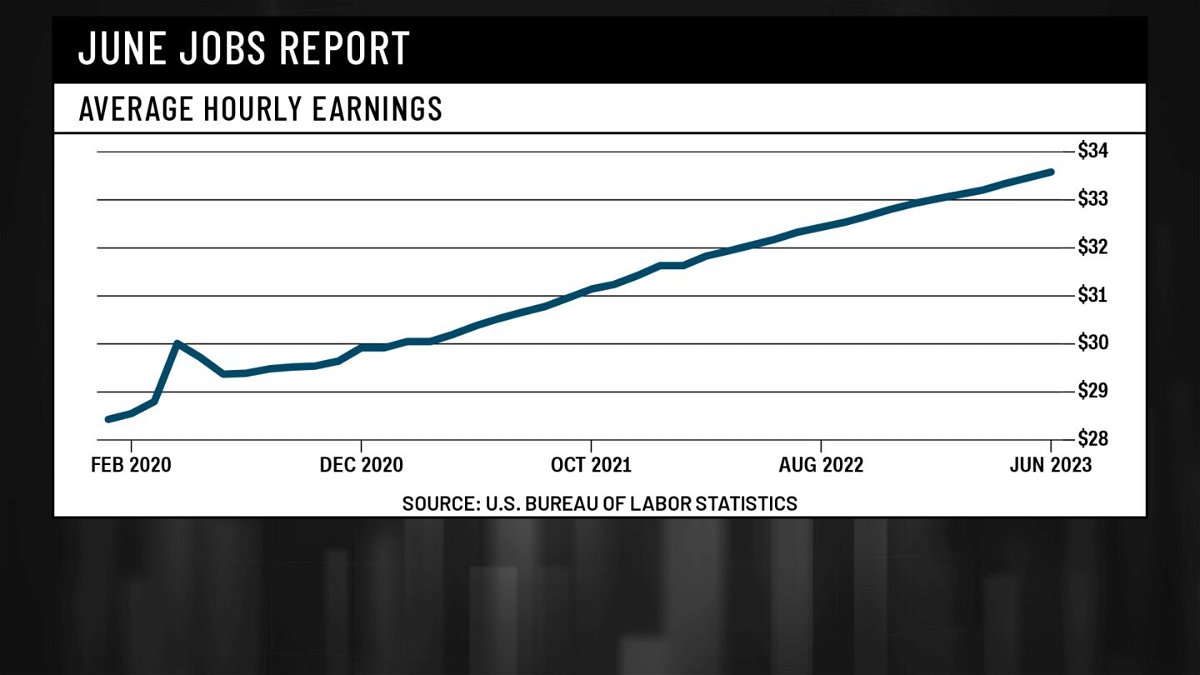

Friday’s report showed that average hourly earnings growth was unchanged at 0.4% from the month before and also unchanged at 4.4% year-over-year.

“The Fed would probably like to see [wage growth] come down a little more,” Lightcast’s Vankudre said. “But it’s so much better than we were a year ago or even in the past six months.”

“In the post-pandemic economy, we’re experiencing some structural and demographic change that has resulted in an economy that’s far less sensitive to interest rates than it has been during previous business cycles,” Joe Brusuelas, RSM US chief economist, told CNN. “So when I see the job gains at this pace, my sense here is that we’re going to need some additional help in terms of cooling of overall inflation, in core services [excluding housing], for the Fed to finally wrap up its efforts to restore price stability.”

Brusuelas said he anticipates that the Fed will resume its rate-hiking ways during its upcoming policymaking meeting later this month and increase its benchmark rate by another quarter point.

“We’re not yet there at the peak in the interest rate hike cycle, but we’re getting closer to it,” he said.

The-CNN-Wire

™ & © 2023 Cable News Network, Inc., a Warner Bros. Discovery Company. All rights reserved.