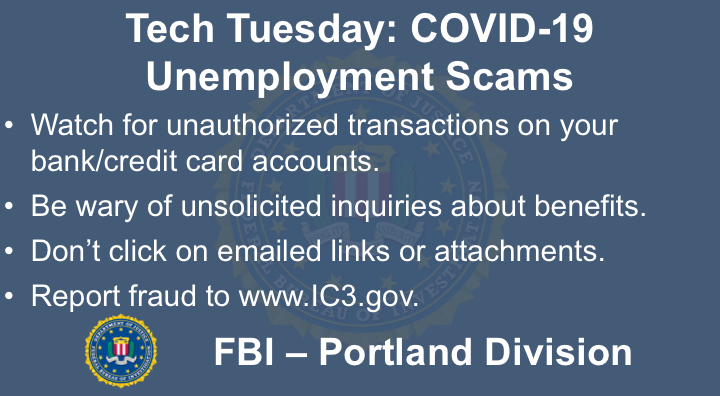

Oregon FBI’s Tech Tuesday: Defending against jobless benefits scams

PORTLAND, Ore. (KTVZ) -- This week, the Oregon FBI’s Tech Tuesday feature focuses on unemployment benefit scams.

During this time of COVID-19, the FBI is seeing a spike in complaints from victims who are having their personally identifiable information (PII) stolen and used by criminal actors to file false unemployment claims.

The criminals obtain the stolen identity using a variety of techniques, including the online purchase of stolen PII, previous data breaches, computer intrusions, impersonation scams where they cold-call victims, email phishing schemes, and more.

Many victims of this scam do not know they have been targeted until they try to file a claim for unemployment insurance benefits themselves. In other cases, victims receive a notification from the state unemployment insurance agency, receive an IRS Form 1099-G showing the benefits collected from unemployment insurance, or get notified by their employer that a claim has been filed while the victim is still employed.

Here’s what to watch for:

- Receiving communications regarding unemployment insurance forms when you have not applied for unemployment benefits

- Unauthorized transactions on your bank or credit card statements related to unemployment benefits

- Any fees involved in filing or qualifying for unemployment insurance

- Unsolicited inquires related to unemployment benefits

- Fictitious websites and social media pages mimicking those of government agencies

Here are some tips on how to protect yourself:

- Be wary of telephone calls and text messages, letters, websites, or emails that require you to provide sensitive information, especially birth dates and Social Security numbers.

- Do not click on or open attachments or links within emails, especially those that come from an unknown sender.

- Monitor your bank accounts on a regular basis and request your credit report at least once a year to look for any fraudulent activity.

- Immediately report unauthorized transactions to your financial institution or credit card provider.

- If you suspect you are a victim, immediately contact the three major credit bureaus to place a fraud alert on your credit records. Also, notify the Internal Revenue Service by filing an Identity Theft Affidavit (IRS Form 14039) through irs.gov or identitytheft.gov.

If you are a victim of identity theft related to fraudulent unemployment insurance claims, also report that fraud to your state unemployment insurance agency, credit bureaus, and your employer’s human resources department.

If you believe you have been the victim of any kind of COVID-19 fraud, make sure to let us know through the FBI’s Internet Crime Complaint Center at www.ic3.gov or call your local FBI office.