State audit finds home mortgage interest deduction ‘deeply inequitable’; Sen. Knopp disagrees

(Update: Adding video, comments from secretary of state, Bend state Sen. Tim Knopp)

BEND, Ore. (KTVZ) — Since 1923 in Oregon, some homeowners have been able to take the interest they pay on their mortgage, and subtract it from their taxable income.

Oregon Secretary of State Shemia Fagan said Wednesday a first-ever audit found the mortgage interest deduction benefits the wealthier residents of urban areas and does not improve rates of homeownership.

“And yet we have this $1.1 billion expenditure every budget cycle for 100 years that has literally never been audited -- until today,” Fagan told NewsChannel 21.

She said the first-ever state audit of the program finds the top 1% of income earners receive more benefit from the tax deduction than the bottom 40% of taxpayers combined.

“But right now, the benefits flow primarily to people who are already wealthy,” Fagan said.

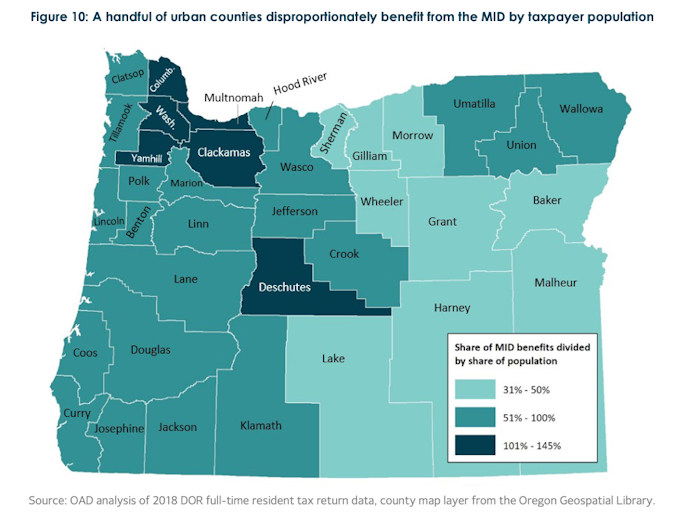

The audit finds Deschutes County is one of seven counties with “a disproportionate share of benefits.”

“So on the one hand, you have people struggling to live in Bend or Redmond or you know, Sunriver, because they want to put their kids in school,” Fagan said. “Yet they can’t even afford a home -- and you have somebody with a vacation home who’s essentially taking a mortgage interest deduction on their primary home and on their vacation home.”

State Sen. Tim Knopp, R-Bend, vice president of the Central Oregon Builders Association, said the main housing crisis issue is with Oregon's land use and housing policies, and the audit is an effort at shifting the blame and vilifying the wealthy.

“I would suggest that middle-class Oregonians who are struggling to make ends meet and who own homes think that the mortgage interest deduction is a critical element,” Knopp said.

The audit says Black, Native American and Latine Oregonians receive disproportionately fewer benefits than white Oregonians.

Oregon Realtors said it supports policies to end racial disparities in homeownership, but has serious concerns that the state is drawing conclusions that it does not have the data to support.

Full statement:

“Oregon REALTORS® is proud of our work to advance policies that help all Oregonians have access to housing, including supporting policies to end racial disparities in homeownership. We reviewed the Secretary of State’s audit on the Mortgage Interest Deduction and have serious concerns that the state is drawing conclusions that it does not have the data to support. We do not have any data on the race or ethnicity of anyone taking the Mortgage Interest Deduction. Here’s what we do know: Of the top ten states with the highest rates of homeownership for Black Americans, eight have the Mortgage Interest Deduction. They also have something else in common: Affordable housing. We can all work together to advance affordable, accessible housing without taking a $1 Billion gamble against taxpayers by ending the Mortgage Interest Deduction.”

The deduction is believed to help increase home ownership, but Fagan said taxpayer money can be better spent on down payment assistance, senior property taxes, credit reports and overall assistance for renters or first-time buyers.

“If the state wants to choose to spend money to help already wealthy people in urban areas have vacation homes, then they should say, ‘That’s the policy of this deduction, and we’re going for it,' right? But right now, it has absolutely no purpose in law,” Fagan said.

Fagan said it's up to state lawmakers to change the law, but her office is ready if they do.

“We will audit it to make sure whatever policy they come up with, the money they spend in that is narrowly tailored to actually help Oregonians get into stable affordable housing,” Fagan said.

Knopp said he supports efforts to close the housing gap for minorities in Oregon.

However, he said he'll absolutely oppose any legislation to change the mortgage interest deduction.

You can read the full audit on the Secretary of State website: https://sos.oregon.gov/audits/Pages/recent.aspx