Jefferson County taxing districts wrestling with budget impacts of PGE tax overpayment get some good news

Two voluntary steps by utility will lessen - but not eliminate - revenue losses

MADRAS, Ore. (KTVZ) – Jefferson County officials met Friday with representatives of dozens of taxing districts, from the library to cities and fire districts, to discuss a $1.8 million property tax over-payment by Portland General Electric, informing them of the utility’s recent agreements to reduce the impacts of repayments on their budgets.

It was first believed PGE’s error in reporting a higher valuation and resulting overpaid taxes would affect only the dozen county tax districts that receive a share of those county tax dollars. But it was more recently learned that based on the tax distribution formula, all of the nearly 40 taxing districts in the county would lose a share of their expected tax revenue for the county to make the required repayment.

PGE, by far the state’s largest taxpayer, holds 17% of Jefferson County’s total tax valuation as of 2022 and pays $3.5 million to $5 million in yearly taxes, the Madras Pioneer reported.

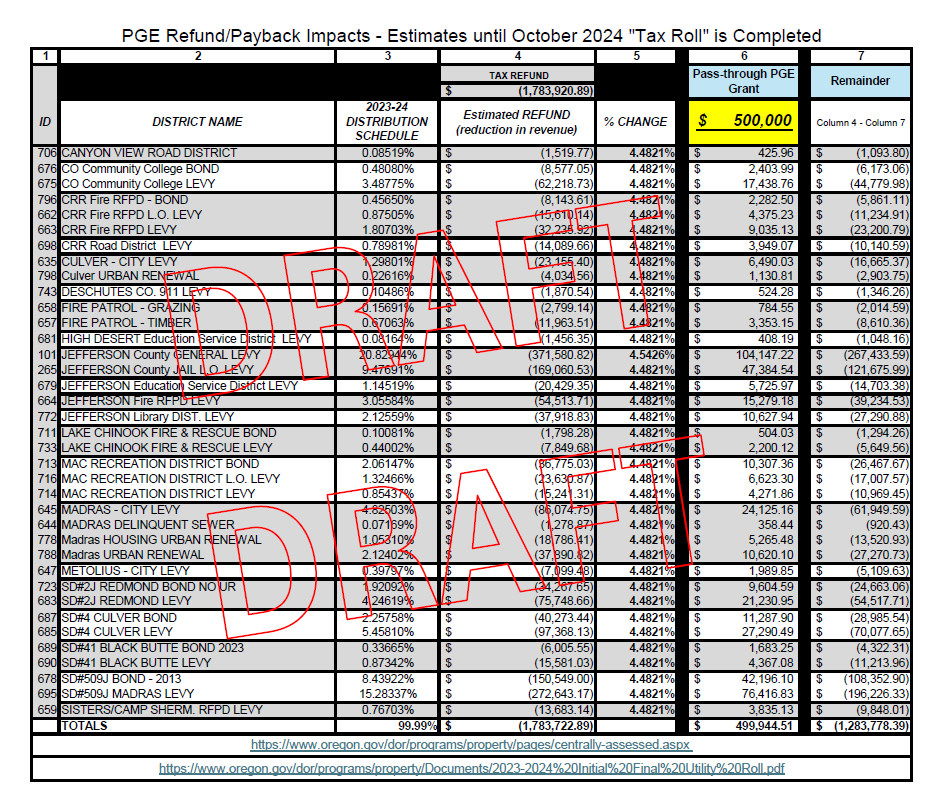

Under state law and Department of Revenue requirements, the overpayment discovered earlier this year must be repaid to the taxpayer – PGE, county Administrator Jeff Rasmussen said as he distributed a draft list of the original and revised refund/payback impacts on each taxing entity in the county.

Since the order was finalized in late July, Rasmussen said there have been discussions with PGE, which agreed to two voluntary efforts to ease the impacts of the paybacks and resulting revenue reductions.

One is that the potential $230,000 in total interest on the tax overpayment would be offered back to the taxing districts. However, the state Department of Revenue has since confirmed that no interest is required to be paid.

Also, tax districts that need help may be offered zero-interest three-year loans to make the repayments, reducing the impact by $270,000, for a total of $500,000 in what the chart referred to as a “pass-through PGE grant.” Rasmussen noted that the funds for that would be paid by company shareholders, trimming the total impact in the county to about $1.3 million.

The chart showed that each taxing district was initially expected to face a nearly 4.5% drop in their tax distribution and also showed the lower figure they’re now expected to face after the $500,000 reduction.

For example, for the Jefferson County general levy - the largest single item on the list, at about 21% of the total county tax revenue distribution - the originally estimated overpayment impact of $371,580 was reduced by over $104,000, to $267,433.

While much smaller under- or over-payment property tax adjustments are not unusual for Oregon counties, Rasmussen said they have instituted new process checks to reduce the risk of such a major error coming to light this way.

While the county worked with the state Department of Revenue to resolve such matters in the past, he said PGE is encouraging county Assessor Ray Soliz to contact them directly when such large increases or drops in assessed value are discovered, to expedite the investigation and outcome.

That’s an attempt to address one concern raised since the error arose – that an issue first discovered months ago only led to word to the various districts of the repayment requirements after the new fiscal and budget year began July 1.

Former county assessor Jean McCloskey said the tax overpayment situation of this magnitude was “probably unprecedented in Oregon.”

And Rasmussen noted that it doesn’t mean a literal repayment to the county - “it’s just revenue you’re not going to receive” after the property tax payments begin this fall. The districts are not expected to cut a check to the county for the repayment, he said.

Soliz explained that his office saw a large increase in PGE’s property value on the utility rolls, and inquiring about that started the eventually costly ball rolling.

While one representative at the in-person and virtual meeting wondered if keeping quiet might have avoided the whole mess, Soliz said, “eventually, I believe PGE would have audited their own books and noted it, and we’d still be faced with having to refund” the overpayment.

There also was another idea raised that will be part of county commissioner discussions that resume next week: the possible use of some $650,000 in uncommitted ARPA (COVID-19 relief) funds in the county budget to ease those the taxing districts’ repayment impacts. It was noted that other taxing districts in the county also received their own ARPA funds, although fire districts did not.

One official at the meeting asked if state Department of Revenue reserve funds could also help in this situation, since as they put it, they were “just a little culpable” in the sequence of events. But that didn’t sound likely.