Why student loan forgiveness remains a key issue for the Biden campaign even after Supreme Court loss

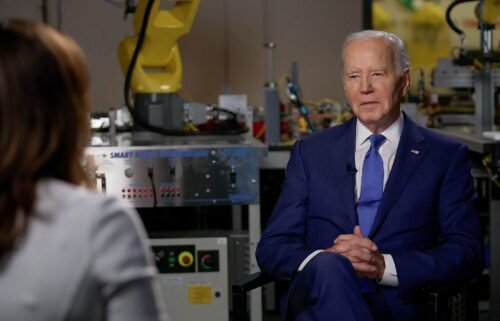

President Joe Biden speaks on his economic plan for the country at Abbots Creek Community Center on January 18

Washington (CNN) — When Americans head to the polls in November, President Joe Biden will have had a direct effect on the household finances of about 4 million of them: He canceled their student loan debt.

More student debt has been forgiven under Biden than any previous administration – but after his signature debt relief program hit a major legal roadblock last year, his historic efforts may fall short of some voters’ expectations.

Sixteen million people received an email from the administration in 2022 notifying them that they qualified for student loan forgiveness under Biden’s new program, which was later struck down by the Supreme Court. No student loan debt was ever canceled under that program.

“We know people are scrambling right now because they made certain financial decisions, because they were expecting debt relief. It’s not like they just read it in a newspaper or heard it from a friend – they got an email,” said Braxton Brewington, press secretary for the Debt Collective, a group advocating for the cancellation of student loan debt.

Still, the Biden campaign sees student debt forgiveness as a winning issue.

“My MAGA Republican friends in the Congress, elected officials and special interests stepped in and sued us and the Supreme Court blocked it. But that didn’t stop me,” Biden said during a stop in California in February.

His administration has made it easier for certain groups of borrowers – like public-sector workers, including teachers; disabled borrowers; and people who were defrauded by for-profit colleges – to qualify for student loan debt forgiveness under existing programs.

Since taking office, Biden’s administration has approved the cancellation of about $144 billion in federal student loans, equal to 9% of the $1.6 trillion of federal student loan debt currently held by borrowers.

That’s about one-third of the amount of student loan debt that would have been canceled by the forgiveness program rejected by the high court, which would have canceled up to $20,000 for borrowers earning less than $125,000 a year.

The administration is working on developing another student loan forgiveness program, relying on a different legal authority this time. The details are expected to be released later this year. Plus, debt cancellations under existing programs are ongoing, and a repayment plan launched last year will make it easier for many current and future borrowers to repay their debt.

As for the Supreme Court decision, Biden has repeatedly said the justices – three of which were appointed by former President Donald Trump, the GOP’s presumptive nominee in 2024 – made a mistake. The Trump campaign has touted the decision as a “massive win.”

“From now until Election Day, we’ll be meeting voters where they are and reminding them early and often that it’s Joe Biden who has their back and Donald Trump who stands in the way of life-changing relief,” said Seth Schuster, a spokesperson for the Biden campaign.

Biden vs. Trump

Democratic Sen. Elizabeth Warren – who initially pushed Biden to cancel up to $50,000 of student loan debt per borrower – believes the choice is simple for voters in the 2024 election when it comes to student debt forgiveness.

“Look at the contrast with Donald Trump. When he was president of the United States, he put Betsy DeVos in as secretary of education, and they tried to block every possible access to student loan debt cancellation that was already in the law,” the Massachusetts senator told CNN.

“Joe Biden is using every tool available to him to cancel as much debt for as many people as he can,” Warren added.

It’s true that the Trump administration made it harder for borrowers to qualify for some forgiveness programs.

One such program provides debt relief for borrowers who can demonstrate that their college misled them in some way – by inflating job placement rates, for example. DeVos stalled the processing of claims made under the program, known as borrower defense to repayment, as she sought to rewrite the regulation, allowing a backlog of more than 100,000 claims to build up.

She also changed the cancellation calculation so that some borrowers were only eligible for partial relief. DeVos was even held in contempt of court for allowing the Education Department to continue collecting on some of those debts.

Biden, on the other hand, has reversed that partial relief calculation and is chipping away at the backlog. So far, he’s canceled $22.5 billion for more than 1.3 million borrowers through the borrower defense program for people who went to schools like the now-defunct, for-profit Corinthian Colleges.

The Trump administration also called for ending the Public Service Loan Forgiveness program, which cancels student debt for eligible public-sector workers who have made 10 years of qualifying monthly payments. It was eliminated from Trump’s proposed federal budget all four years he was in office. Congress never adopted the proposal.

Biden has expanded PSLF eligibility and is conducting a recount of past payments to fix any past servicing errors and make sure borrowers get credit for every payment they’ve made.

Before Biden took office, just 7,000 people had ever received debt relief under the program. Under Biden, about 871,000 borrowers have qualified for PSLF and received a total of $62.5 billion in loan forgiveness.

‘Rolling the dice’ on the Supreme Court

For some student loan forgiveness advocates, it’s not enough that the Biden administration tried – and failed – to implement a sweeping program.

“I think borrowers saw the Biden administration roll the dice on the Supreme Court, which was not a good bet,” said Brewington.

There’s currently a supermajority of conservatives on the high court.

“Knowing that we’re dealing with a hostile court, we were saying that really the best way to get through this is to automatically implement relief … to sort of avoid the bureaucratic application process,” he said.

But that’s not what happened.

Biden announced the loan forgiveness plan in August 2022, but the application wasn’t formally launched until two months later – which was also after several conservative-backed lawsuits were filed alleging the program was illegal. Just days later, in late October 2022, the program was paused by a federal appeals court.

On the day the Supreme Court knocked down Biden’s signature program in 2023, he announced that his administration would pursue another route. Since then, the Department of Education has been working on developing another plan, undertaking a formal process, known as “negotiated rulemaking,” which typically takes months.

Brewington said he remains hopeful that the new program will benefit a broad swath of borrowers but will be closely watching how fast the relief could be delivered.

“It won’t matter if no one can get it,” he said.

Student debt policy has come a long way

Still, student loan borrower advocates agree that forgiveness for nearly 4 million people is worth acknowledging. Before the 2016 presidential campaign, broad student debt cancellation was not an issue that candidates usually campaigned on.

“We have seen how far that we have come and that the only way to continue to see debt cancellation is to ensure that we are turning out the vote,” said Wisdom Cole, the national director of the NAACP Youth & College Division.

Cole also served on the Department of Education’s rulemaking committee tasked with developing the new student loan forgiveness program.

He said it’s clear that student loan forgiveness remains a priority for the administration, noting how one of first lady Jill Biden’s guests at the State of the Union in early March was a teacher who received debt relief under PSLF.

“The transparency around the plans to make cancellation a reality is top of mind for Black Americans, particularly young Black Americans,” Cole said.

Overall, 32% of registered voters say student loan debt is “very important” for presidential candidates to talk about, according to a recent poll by KFF. But for younger voters, ages 18-29, 46% say it’s very important.

Despite the progress made to tackle student loan debt, there has been little change in federal policy to address the core underlying issue: the high cost of college. Warren has called for making public, two- and four-year colleges free, and Biden has pushed for making two years of community college free, but that proposal hasn’t come up for a vote in Congress.

Cole said the NAACP will continue to advocate for policies that ensure people can graduate with a college degree without taking on debt.

“We’re seeing lives changed in real time. We want to see this for as many people as possible,” Cole said.

CNN’s Ariel Edwards-Levy contributed to this report.

The-CNN-Wire

™ & © 2024 Cable News Network, Inc., a Warner Bros. Discovery Company. All rights reserved.