Is gap insurance worth it to pay off your auto loan when your car is totaled?

alexgo.photography // Shutterstock

Is gap insurance worth it to pay off your auto loan when your car is totaled?

Rear view of tow truck transporting 3 totaled damaged cars concept insurance paid off the actual cash value

If your vehicle gets totaled or stolen and you owe more on the loan than what your car is worth, gap insurance can help. Several factors will determine if gap insurance is worth it for you, including cost, coverage options and providers. But, it’s relatively low-cost coverage that can provide added financial security and prevent you from paying money out of pocket.

Edmunds offers a guide to gap insurance and addresses the question of when and why it may be worth getting.

What is gap insurance?

Gap insurance is supplemental auto coverage, in addition to comprehensive and collision insurance, that pays off a loan balance in the event your vehicle is totaled or stolen and never found and you owe more than what the car is worth.

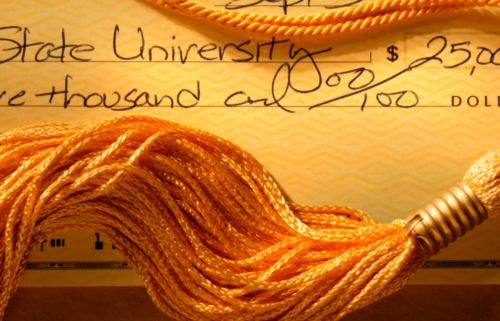

For example, say you financed a new car less than a year ago and then it gets totaled in an accident. Your car is valued at $27,000 but your loan payoff is $25,500. You pay your $500 deductible but still owe $5,000. Standard auto insurance policies are designed to only cover the current market value of a vehicle when a claim is made. And that value depreciates over time.

That’s where gap insurance comes in handy: It covers the additional cost for you. In this example, gap insurance will pay that $5,000 difference so you don’t have to. However, what’s considered a “total loss” varies by state and by auto insurance provider.

When to get gap insurance

If you’re financing a vehicle purchase, your lender may require you to have gap insurance. This requirement can include vehicles that may depreciate at faster rates, such as luxury sedans or SUVs. Some insurance companies might also require your vehicle to be brand-new in order for you to purchase gap insurance. This usually means your vehicle is under 3 years old and that you are the original owner.

However, gap insurance makes sense when your auto loan balance is likely to exceed the actual value of the car. This usually happens when:

- You put little or no money down when you financed your car.

- Your trade-in vehicle was less than what you owed on that loan, and that amount was added to your new car loan.

- Your newly financed car has a low resale value.

- You plan to add lots of miles on your car, which will impact your car’s value quickly.

- You’ve taken out a long-term car loan of 60 months or more.

You do not need gap insurance if you owe less than your car’s value or can afford to pay the difference between the amount owed and the car’s value if something happens.

Where to get gap insurance

Gap insurance is typically offered at a dealership when you are financing a new vehicle. Most banks, credit unions and auto insurance companies also offer supplemental gap coverage on top of comprehensive and collision policies.

While it is suggested that you get gap insurance as soon as you purchase or lease your vehicle, you may still add this coverage up to 12 months after financing your car, depending on your insurance agency.

Gap insurance costs

The cost of gap insurance usually depends on the make and model of a vehicle, the rate of depreciation, your age, and your vehicle claims history. It also varies by state. According to USA Today, the average cost is $60 a year for coverage through an auto insurance provider.

An insurer typically prices coverage at 5% to 6% of collision and comprehensive premiums, according to the Insurance Information Institute. Gap coverage is usually cheaper through an insurance company versus a dealer or lender. If you purchase coverage through a private lender, or at the time of financing or leasing at a dealership, you will likely pay a flat fee between $500 and $700. If you add the cost of gap coverage into your car loan, you also will likely pay interest on it.

Gap insurance alternatives

Still not sure if gap insurance is worth it? There are other options. Some auto insurance companies offer coverage similar to gap insurance, such as new car replacement coverage and better car replacement coverage.

New car replacement coverage reimburses you enough money to replace your totaled or stolen vehicle with a new car of the same make and model. This is different from gap coverage because new car replacement insurance doesn’t factor in depreciation. To qualify for this type of coverage, you must have a collision and comprehensive policy and meet certain mileage requirements.

Better car replacement coverage is exactly how it sounds: You get money for a “newer” or “better” model of your car. This insurance also has mileage requirements and is only available to those who have financed, not leased, their vehicles.

This story was produced by Edmunds and reviewed and distributed by Stacker Media.

![]()