Global markets drop after rocky day on Wall Street

Asian and European stocks fell on September 28 after another turbulent day for US markets

By Michelle Toh and Anna Cooban, CNN Business

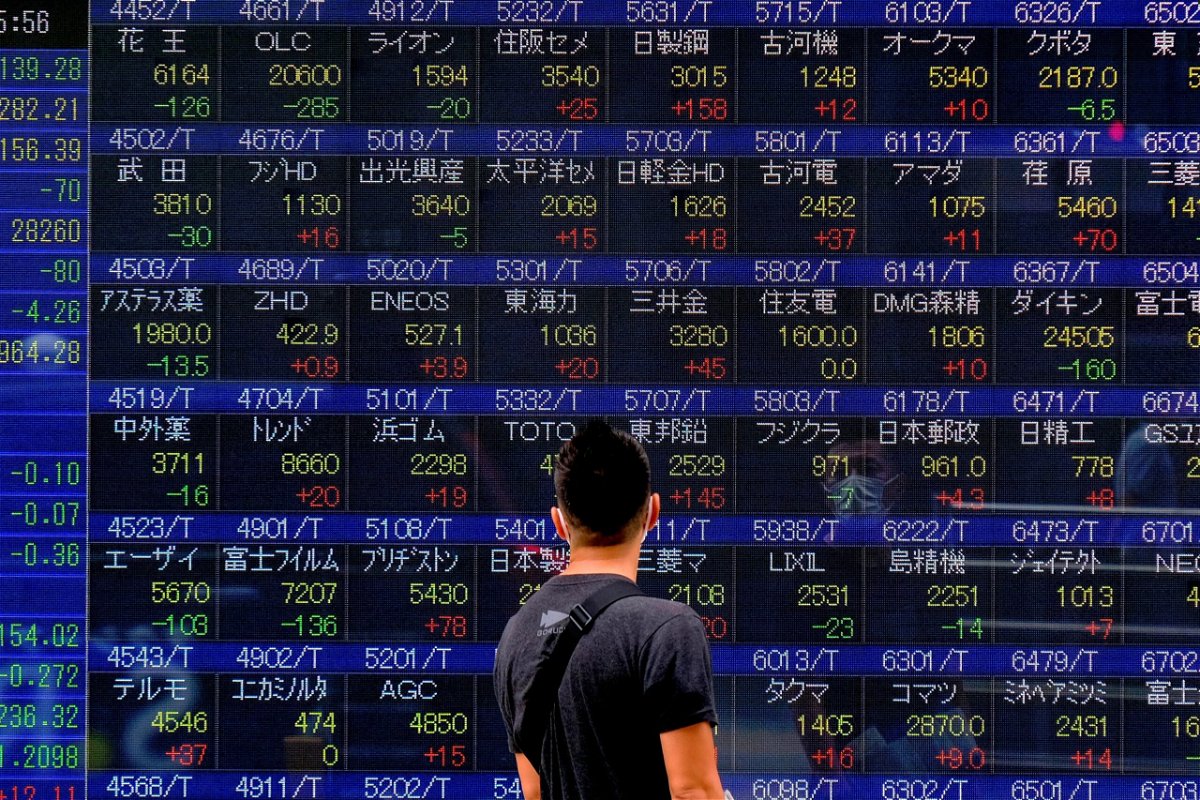

Asian and European stocks fell Wednesday after another turbulent day for US markets, as investors continue to sell off amid fears of global inflation, further interest rate hikes and broader economic turmoil.

The UK’s FTSE 100 Index dropped 1.6% in morning trading Wednesday, after a rocky few days that saw the value of the pound fall to an all-time low. Germany’s DAX slipped 1.7% and France’s CAC dropped 1.3%.

Japan’s benchmark Nikkei index slid 1.5%, China’s benchmark Shanghai Composite index dropped 1.6%, while Hong Kong’s Hang Seng Index plunged more than than 3.4% to its lowest close in nearly 11 years.

The falls come after another volatile day on Wall Street, with the Dow and S&P 500 reaching their lowest levels since November 2020. That put the Dow deeper into a bear market, as it fell more than 125 points, or 0.4%. The S&P 500, meanwhile, pointed down 0.2%.

The Nasdaq however, closed up 0.3% — eking out its first gain since September 19.

As of 5.30 a.m. ET on Wednesday, US stock futures were pointing down.

The US Federal Reserve’s aggressive rate-hiking policy and Britain’s newly announced tax cuts have spiked investor jitters around the world, and caused the US dollar to surge. But the greenback’s rally is also feeding investor concerns, Societe Generale’s Kit Juckes noted Monday, as large surges historically occur alongside global economic crises.

Consumers globally have also already been struggling to adjust to rising prices across the board, from food to basic necessities.

Investors are worried about the likelihood of inflation continuing to worsen — and that the Fed will keep raising rates sharply for the foreseeable future.

“Fed members are all singing from the same hymn book. They are willing to weaken the economy to bring inflation in check,” said Alex Chaloff, co-head of investment strategies at Bernstein Private Wealth Management.

“They are saying it over and over and over again because, up until 10 days ago, the market didn’t believe them,” Chaloff said.

— Nicole Goodkind contributed to this report.

The-CNN-Wire

™ & © 2022 Cable News Network, Inc., a Warner Bros. Discovery Company. All rights reserved.