‘Game-changer’: Oregon Department of Revenue partners with IRS to offer free income tax e-filing option for 2025 returns

SALEM, Ore. (KTVZ)—Oregon resident taxpayers preparing their own tax returns in 2025 will have the option to electronically file both their federal and state income tax returns using the combination of IRS Direct File and Direct File Oregon, the IRS and the Oregon Department of Revenue announced Thursday.

“The Direct File Program is a game-changer for taxpayers,” Governor Tina Kotek said. “This free filing option is an equitable opportunity to save Oregonians time and money, regardless of their income."

The IRS and US Treasury Department announced an expansion of the types of returns that can be filed using IRS Direct File beyond what was available in the pilot program during the 2024 tax filing season.

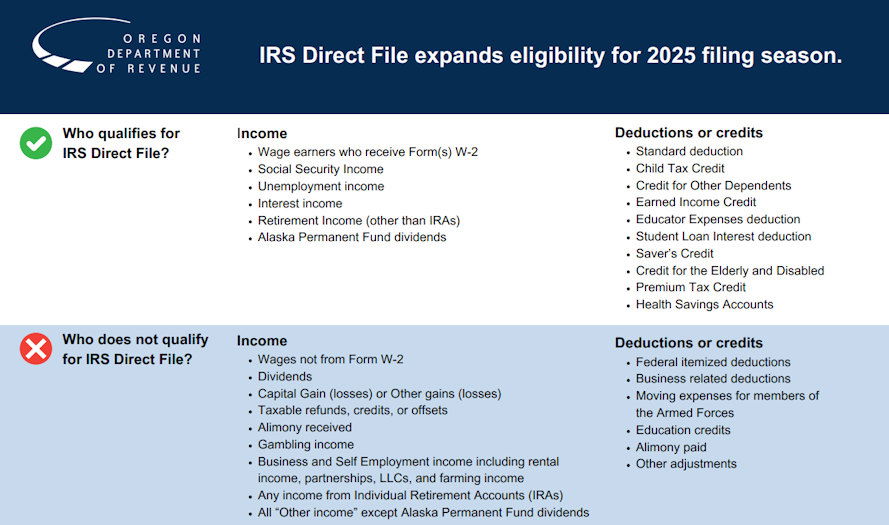

During the pilot last year, IRS Direct File covered limited tax situations, including wage income reported on a W-2 form, Social Security income, unemployment compensation and certain credits and deductions. For the 2025 filing season, IRS Direct File will support Forms 1099 for interest income greater than $1,500, retirement income and the Form 1099 for Alaska residents reporting the Alaska Permanent Fund dividend. (See graphic for more on who will be able to use IRS Direct File in 2025.)

In the 2024 tax season, more than 140,000 taxpayers in 12 states filed their federal tax returns using the limited pilot program, while nearly 7,000 Oregon taxpayers filed their state returns using the free, state-only Direct File Oregon option.

The IRS estimates that 30 million US taxpayers will be able to use IRS Direct File in 2025, including 640,000 Oregon taxpayers who will be able to e-file both their federal and state returns for free.

The U.S. Department of the Treasury announced in May that it would make IRS Direct File a permanent option for taxpayers and invited all 50 states to participate to create a seamless free filing system for both federal and state taxes. Oregon was the first of 12 new states to accept the invitation from the IRS in June.

“Connecting Direct File Oregon with the IRS Direct File option beginning next year will give Oregon taxpayers a seamless way to electronically file both their federal and state income tax returns—and do both for free,” Oregon Department of Revenue Director Betsy Imholt said.

--

--

Taxpayers in 24 states will be able to file their returns directly with the IRS in 2025

WASHINGTON (AP) — The IRS is expanding its program that allows people to file their taxes directly with the agency for free.

The federal tax collector’s Direct File program, which allows taxpayers to calculate and submit their returns to the government directly without using commercial tax preparation software, will be open to more than 30 million people in 24 states in the 2025 filing season.

The program was rolled out as a pilot during the 2024 tax season in 12 states.

Now IRS Commissioner Daniel Werfel says the program will be permanent and the IRS will expand eligibility opportunities for taxpayers.

“We're announcing significant expansions of Direct File that will make the service available to millions more taxpayers in 2025,” Werfel said on a call Thursday with reporters. He said it is possible that additional states could still choose to join the program in 2025.

The pilot program in 2024 allowed people in certain states with very simple W-2s to calculate and submit their returns directly to the IRS. Those using the program claimed more than $90 million in refunds, the IRS said.

It was originally available to certain taxpayers in California, New York, Arizona, Florida, New Hampshire, Nevada, South Dakota, Tennessee, Texas, Washington, Wyoming and Massachusetts.

States to be added in 2025 include: Alaska, Connecticut, Idaho, Kansas, Maine, Maryland, New Jersey, New Mexico, North Carolina, Oregon, Pennsylvania and Wisconsin.

In addition, new eligibility standards will allow participation by taxpayers with 1099 income and credits including the Child and Dependent Care Credit, Retirement Savings Contributions Credit, and the deduction for Health Savings Accounts, among others.

"Other countries have been providing their citizens with the ability to do this type of thing for years," Treasury Deputy Secretary Wally Adeyemo said on the call with reporters. Several nations in the Organization for Economic Cooperation and Development, including Germany and Japan, have similar systems with prepopulated tax forms.

The direct file idea is not viewed favorably by the commercial tax prep software firms that have made billions of dollars from charging people to use their software.

Additionally, an IRS inspector general report released this week notes that the IRS has not maintained sufficient safeguards over data protection related to the IRS Free File Alliance. The alliance is a longstanding agreement between the IRS and some commercial tax preparation companies to provide free tax prep services to low and middle-income taxpayers.

The Free File Alliance is separate from the Direct File program.

The IRS was tasked with looking into how to create a “direct file” system as part of the money it received from the Inflation Reduction Act signed into law by President Joe Biden in 2022. It gave the IRS nine months and $15 million to report on how such a program would work.